Central bank depository: No consensus on monetary policy.

SEI’s view

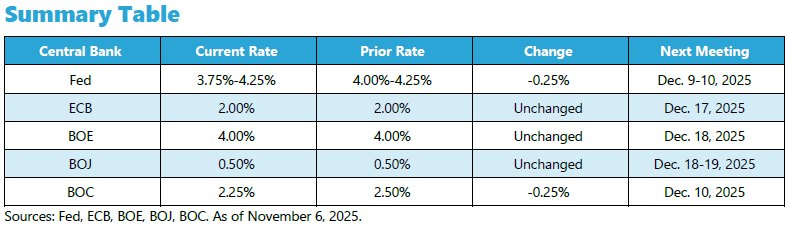

The Federal Reserve (Fed) cut the federal funds rate by 25 basis points (0.25%) at its October meeting. This follows a similar reduction in September. Markets are pricing in yet another rate cut at the next meeting scheduled for December 9-10. Given the U.S. government shutdown, the Fed’s decision-makers must rely on anecdotal reports, private sources, and the central bank’s regional surveys to assess the current state of the economy. The Fed is keying on signs of labor-market softness to justify its monetary policy easing moves. However, resilient consumer spending and booming artificial intelligence (AI)-related capital expenditures suggest that the overall economy continues to advance at a decent pace. The government shutdown, which is now the longest in American history, prolongs the economic uncertainty. The U.S. Supreme Court’s eventual judgment regarding the constitutionality of the tariffs will also influence the Fed’s monetary posture in the months ahead. Elsewhere, the Bank of Canada (BOC) reduced its policy rate for the fourth time this year as the country faces near-recessionary conditions. The European Central Bank (ECB) chose yet again to maintain its policy rate at 2.00% amid signs that inflation has steadied near its target. The Bank of England (BOE) voted to keep the Bank Rate unchanged at 4.00% and indicated that future rate cuts would be dependent upon the outlook for inflation. The Bank of Japan has been on hold since January of this year, even though inflation has been running at a surprisingly high 3% rate.

Federal Reserve (Fed)

- In a split 10-2 vote, the Federal Open Market Committee (FOMC) reduced the federal funds rate by 0.25% to a range of 3.75%-4.00% following its meeting on October 28-29—its second consecutive rate cut after standing pat for eight months. FOMC member Stephen Miran voted for a 0.50% rate decrease, while Jeffrey Schmid preferred to leave the federal funds target rate unchanged.

- In a statement announcing the rate decision, the FOMC cited the continued sluggishness in the U.S. labor market. "Job gains have slowed this year, and the unemployment rate has edged up but remained low through August; more recent indicators are consistent with these developments," the FOMC commented. The Committee also noted that inflation "remains somewhat elevated."

- During a news conference following the FOMC meeting, Fed Chair Jerome Powell acknowledged the differing views among FOMC members regarding monetary policy and cautioned that a rate cut at the Committee's meeting in December "is not a foregone conclusion—far from it. Policy is not on a pre-set course."

European Central Bank (ECB)

- The ECB left its benchmark interest rate unchanged at 2.00% for its third consecutive meeting on October 30, as inflation in the region remains relatively tame and the economy continues to expand modestly.

- In a news release, the ECB’s Governing Council noted, “Inflation remains close to the 2% medium-term target and the Governing Council’s assessment of the inflation outlook is broadly unchanged. The economy has continued to grow despite the challenging global environment.” However, the central bank did not provide guidance on the direction of monetary policy going forward, citing uncertainty regarding ongoing global trade disputes and geopolitical tensions.

- At a post-meeting news conference in Florence, Italy, ECB President Christine Lagarde said, “From a monetary policy point of view, we are in a good place.” She also commented that the central bank “will do whatever is needed to make sure that we stay in a good place.”

Bank of England (BOE)

- At its meeting on November 6, the BOE voted by a slim 5-4 margin to maintain the Bank Rate at 4.00%—its lowest level since March 2023. Four BOE Monetary Policy Committee (MPC) members favored a 0.25% reduction to the policy rate.

- According to minutes of the meeting, the MPC members “judged that the restrictiveness of monetary policy had fallen as the Bank Rate had been reduced. The extent of further reductions would therefore depend on the evolution of the outlook for inflation. If progress on disinflation continued, Bank Rate was likely to continue on a gradual downward path.”

- During a news conference following the meeting, BOE Governor Andrew Bailey said that the central bank believes that U.K. inflation has peaked at its current rate of 3.8%, noting that “upside risks to inflation have become less pressing since August [the date of the BOE’s most recent rate cut].” Bailey also commented, “With every cut in the Bank Rate, how much further to go becomes a closer call. For me, the market curve at the moment does give a reasonable view, I think, of a sensible path.”

Bank of Japan (BOJ)

- By a 7-2 majority, the BOJ voted to leave its benchmark interest rate unchanged at 0.50% at its meeting on October 29-30, but signaled that rate hikes may be needed in the not-too-distant future. The central bank has stood pat since raising the rate by 0.25% in late January of this year. Two BOJ Policy Board members favored a 0.25% increase in the policy rate to 0.75%.

- In a statement announcing the rate decision, the BOJ said that inflation “is likely to decelerate to a level below 2 percent through the first half of fiscal 2026, with the waning of the effects of the rise in food prices, such as rice prices. Meanwhile, underlying [consumer-price index] inflation is likely to be sluggish, mainly affected by the growth pace of the economy.”

- At a news conference following the meeting, BOJ Governor Kazuo Ueda noted that the BOJ is waiting for “a bit more data” to determine if Japanese companies will continue to increase employees’ wages despite rising costs due to the U.S. tariffs. “I'm not saying that we need to wait until the final outcome of next year's wage talks becomes available,” he said. “We want to gather a bit more data on the initial momentum of the talks."

Bank of Canada (BOC)

- At its October 29 meeting, the BOC reduced its policy rate by 0.25% to a three-year low of 2.25%. The central bank has cut the rate by an aggregate of 0.50% at its last two meetings after remaining on hold for the previous six-month period.

- In a statement announcing the monetary policy decision, the BOC cited concerns regarding U.S. trade policy. “While the global economy has been resilient to the historic rise in U.S. tariffs, the impact is becoming more evident,” the central bank commented. “Trade relationships are being reconfigured and ongoing trade tensions are dampening investment in many countries.”

- During a news conference following the rate-cut announcement, BOC Governor Tiff Macklem said that the rate cut “reflects ongoing weakness in the economy and contained inflationary pressures.” Macklem also reiterated the uncertainty surrounding the Trump administration’s tariffs on imported goods from Canada. “There continues to be considerable uncertainty, both about U.S. tariffs and their impacts,” he stated. “The range of possible outcomes is wider than usual.”

Important Information

This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. All information as of the date indicated. There are risks involved with investing, including possible loss of principal. This information should not be relied upon by the reader as research or investment advice, (unless you have otherwise separately entered into a written agreement with SEI for the provision of investment advice) nor should it be construed as a recommendation to purchase or sell a security. The reader should consult with their financial professional for more information.

Statements that are not factual in nature, including opinions, projections, and estimates, assume certain economic conditions and industry developments and constitute only current opinions that are subject to change without notice. Nothing herein is intended to be a forecast of future events, or a guarantee of future results,

Certain economic and market information contained herein has been obtained from published sources prepared by other parties, which in certain cases have not been updated through the date hereof. While such sources are believed to be reliable, neither SEI nor its affiliates assumes any responsibility for the accuracy or completeness of such information and such information has not been independently verified by SEI.

There are risks involved with investing, including loss of principal. The value of an investment and any income from it can go down as well as up. Investors may get back less than the original amount invested. Returns may increase or decrease as a result of currency fluctuations. Past performance is not a reliable indicator of future results. Investment may not be suitable for everyone.

This material is not directed to any persons where (by reason of that person's nationality, residence or otherwise) the publication or availability of this material is prohibited. Persons in respect of whom such prohibitions apply must not rely on this information in any respect whatsoever.

The information contained herein is for general and educational information purposes only and is not intended to constitute legal, tax, accounting, securities, research or investment advice regarding the strategies or any security in particular, nor an opinion regarding the appropriateness of any investment. This information should not be construed as a recommendation to purchase or sell a security, derivative or futures contract. You should not act or rely on the information contained herein without obtaining specific legal, tax, accounting, and investment advice from an investment professional.

Information in the U.S. is provided by SEI Investments Management Corporation (SIMC), a wholly owned subsidiary of SEI Investments Company (SEI).

Information in Canada is provided by SEI Investments Canada Company, a wholly owned subsidiary of SEI Investments Company (SEI), and the Manager of the SEI Funds in Canada.

In the UK and the EEA this information issued in the UK by SEI Investments (Europe) Ltd, 1st Floor, Alphabeta, 14-18 Finsbury Square, London EC2A 1BR which is authorised and regulated by the Financial Conduct Authority.

The contents of this document have not been reviewed by any regulatory authority in Hong Kong. You are advised to exercise caution in relation to the offer. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice.

This document has not been registered as a prospectus with the Monetary Authority of Singapore.

This information is made available in Latin America and the Middle East FOR PROFESSIONAL (non-retail) USE ONLY by SIEL.

Any questions you may have in relation to its contents should solely be directed to your Distributor. If you do not know who your Distributor is, then you cannot rely on any part of this document in any respect whatsoever.

Issued in South Africa by SEI Investments (South Africa) (Pty) Limited FSP No. 13186 which is a financial services provider authorised and regulated by the Financial Sector Conduct Authority (FSCA). Registered office: 3 Melrose Boulevard, 1st Floor, Melrose Arch 2196, Johannesburg, South Africa.