Quarterly Market Commentary: Monetary policy and robust earnings cheer investors.

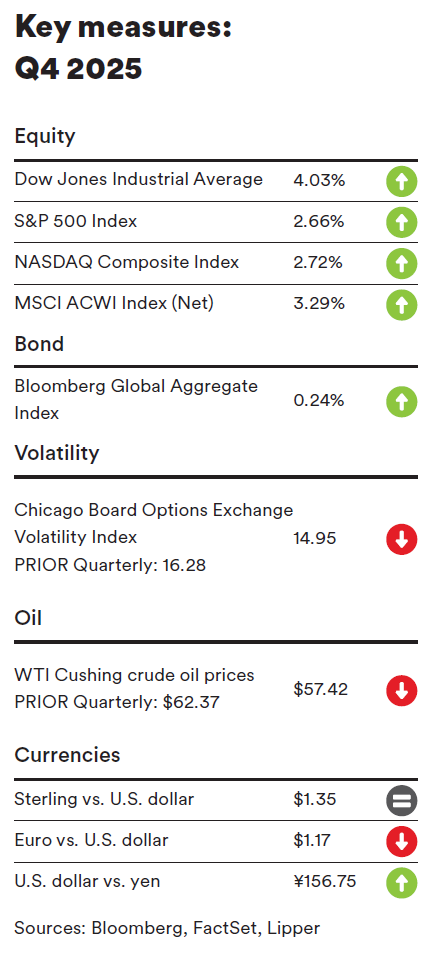

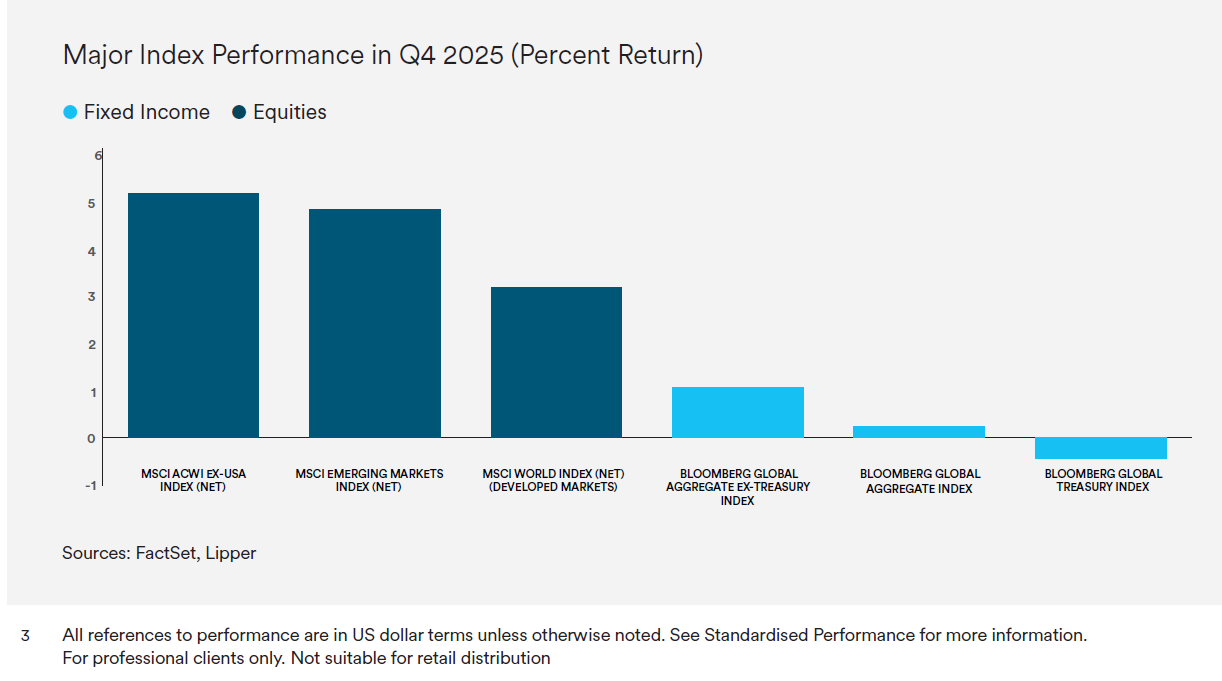

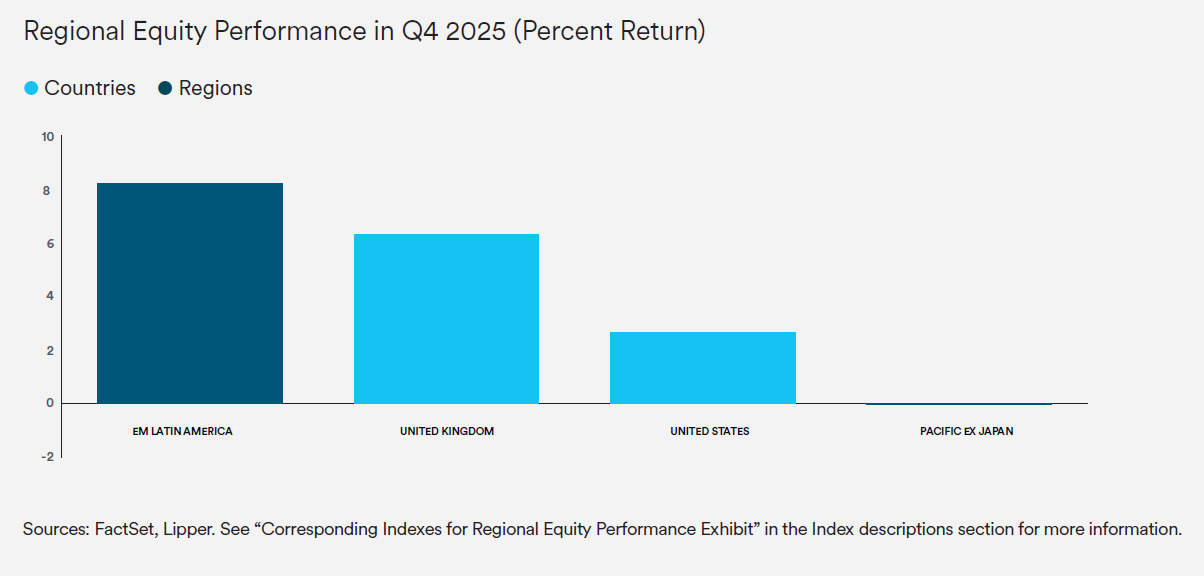

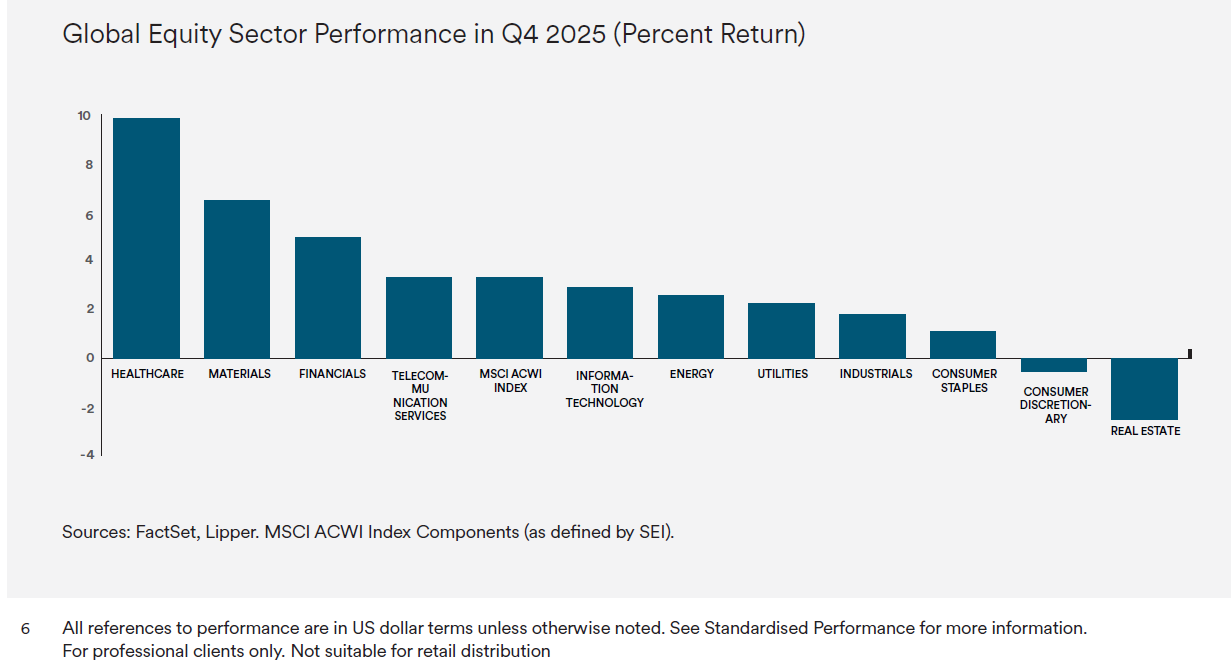

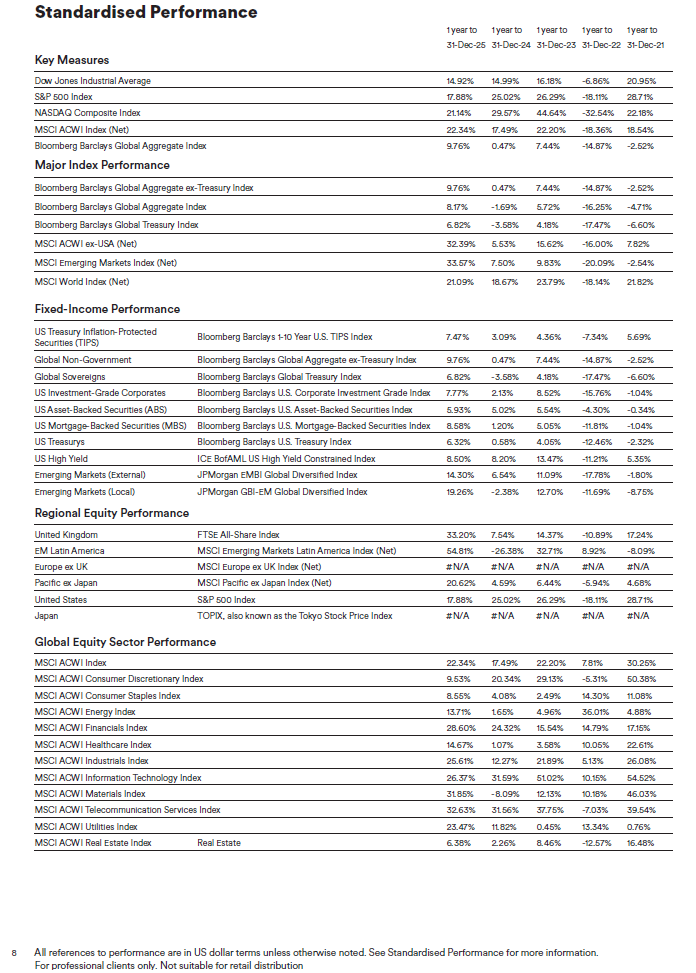

Global equities, as measured by the MSCI ACWI Index, garnered positive returns in the fourth quarter of 2025. Investors were encouraged by central bank monetary policy easing, relatively strong corporate earnings, and softening trade tensions between the U.S. and China. Emerging markets outperformed developed markets for the quarter.

The Nordic countries were the strongest performers among the developed markets for the fourth quarter led by Finland and Sweden. Europe benefited from sharp upturns in Austria, Ireland, Spain, and Switzerland. The Pacific ex Japan and Pacific regions underperformed due to market downturns in Australia and New Zealand. Europe and Eastern Europe were the top emerging market performers over the quarter, bolstered by strength in Hungary and Poland. Conversely, Chinese stocks listed on the Hong Kong Stock Exchange recorded negative returns. The Gulf Cooperation Council (GCC) countries also lagged due to weakness in Saudi Arabia, Qatar, and Kuwait.

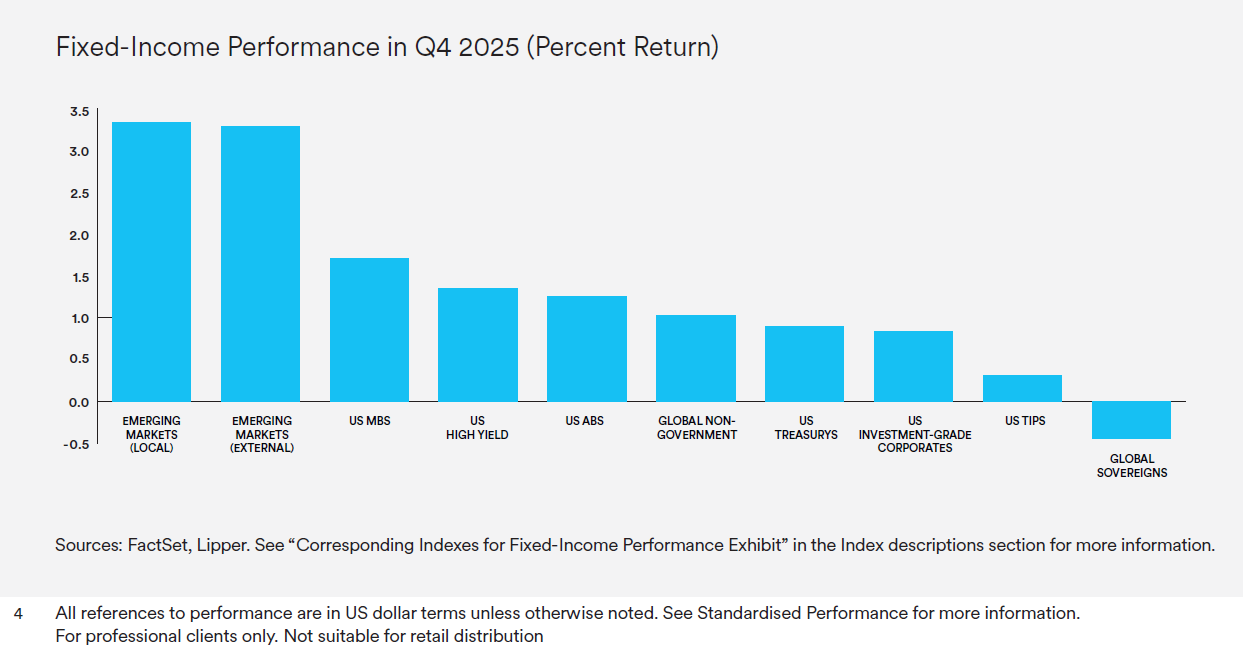

Global fixed-income assets, as represented by the Bloomberg Global Aggregate Bond Index, edged up 0.2% (in U.S. dollars) in the fourth quarter. Mortgage-backed securities (MBS) led the U.S. fixed-income market, followed by high-yield bonds, investmentgrade corporate bonds, and U.S. Treasury securities. Treasury yields modestly declined in the short and intermediate parts of the yield curve, and moved slightly higher in the 7-, 10-, 20-, and 30-year segments. (Bond prices move inversely to yields.) Yields on 2-, 3-, and 5-year Treasury notes dipped by corresponding margins of 0.13%, 0.06%, and 0.01%, ending the quarter at 3.47%, 3.55%, and 3.73%, respectively, while the 10-year yield ticked up 0.02% to 4.18% The 10-year to 3-month yield curve widened by 35 basis points (0.35%) to +0.51% as of the December 31.1

Global commodity prices, as measured by the Bloomberg Commodity Index, rose 5.8% in the fourth quarter. The spot prices for West Texas Intermediate (WTI) and Brent crude oil fell 7.9% and 7.8%, respectively, during the quarter due to increased output from both Organization of the Petroleum Exporting Countries (OPEC) and non-OPEC producers and softer demand. Additionally, investors were concerned that a proposed peace plan for the Russia-Ukraine conflict, released in November, could increase exports from Russia. The 12.1% rise in the gold price for the quarter was in response to Federal Reserve (Fed) interest-rate cuts in November and December, as well as escalating geopolitical tensions, particularly the U.S. government’s blockade of Venezuelan oil tankers in the Caribbean Sea. On 3 January, U.S. military forces invaded Venezuela and arrested President Nicolás Maduro and his wife, Cilia Flores, on numerous charges, including cocaine importation conspiracy and possession of machine guns. After climbing steadily for much of the quarter, the New York Mercantile Exchange (NYMEX) natural gas price ended the period down 5.2% following a steep decline in late December. The downturn was attributable mainly to investors’ profit-taking, a decrease in demand due to forecasts of milder winter weather in parts of the U.S., as well as record high output and rising inventories.

On 12 November, President Donald Trump signed a spending package to reopen the federal government after a 43-day shutdown—the longest in U.S. history—after the House of Representatives and Senate passed the legislation by votes of 222-209 and 60-40, respectively. The political dispute centered on the demand of the Democrats, who are the minority party in both houses of Congress, for an extension of the enhanced Affordable Care Act (ACA) health insurance subsidies enacted during the COVID-19 pandemic in 2021, and to restore the cuts to the Medicaid program mandated in the One Big Beautiful Bill Act, which Trump signed into law in July.

The agreement funds the government through January 30, 2026; provides full funding through the end of the fiscal year on 30 September for the Department of Agriculture, the legislative branch, and military construction; and guarantees the rehiring of furloughed workers and back pay for all federal employees. Furthermore, though the bill did not extend the Affordable Care Act (ACA) subsidies, the Senate pledged to hold a vote on the issue by mid-December. However, the proposed legislation on the subsidies failed to garner the 60 votes needed to pass.

There was an unexpected development regarding U.S. trade policy in mid-November. The Trump administration reversed several tariffs that were previously imposed on food imports in an effort to cut costs for both consumers and businesses, and ease inflationary pressures in the food sector. The lower tariffs, which were applied retroactively to 13 November, include beef, coffee, and more than 100 agricultural and food products. The lower levies apply to imports from all countries—not just those with trade deals. Several U.S.-based businesses have challenged the legality of the tariffs with the U.S. Supreme Court, which could issue a decision on the matter sometime in January. Additionally, just before the end of the year, Trump announced a one-year delay for tariffs on imported lumber based goods, including upholstered furniture, kitchen cabinets, and vanities. The levies were scheduled to take effect on 1 January.

On the geopolitical front, in late November, the Trump administration announced a plan to end the Russia-Ukraine war, which began in February 2022. The plan would provide limited security guarantees for Ukraine, excluding direct military assistance. However, Ukraine would be required to cede the eastern Donbas region to Russia and accept Russia’s control over other contested regions. Additionally, the plan would limit Ukraine’s military forces to 600,000 members and bans Ukraine from joining the North Atlantic Treaty Organization (NATO), which provides security guarantees for its member nations.

In late December, Trump discussed the peace plan in a phone call with Russian President Vladimir Putin and met with Ukrainian President Volodymyr Zelensky at his Mar-A-Lago home in Florida. Trump and Zelensky reviewed a revised draft peace plan, which includes a referendum on territorial concessions and presidential elections in Ukraine. The original U.S. proposal faced criticism for being too favorable to Russia. Putin agreed to create two working groups—security and economic—with discussions expected to start in early January. Following the meeting, Trump and Zelensky expressed optimism that they could reach an agreement. However, it appeared that significant disputes—particularly over territory—could dampen the chances of a resolution in the near future.

Economic data

U.S.

Following a delay due to the ongoing federal government shutdown, the Department of Labor released its inflation report for November. The consumer-price index (CPI) advanced by 2.7% year-over-year in November, down from the 3.0% rise in September and below expectations. (The government did not release inflation numbers for October and month-over-month changes for most items for November as the Bureau of Labor Statistics was unable to collect the data due to the government shutdown. Fuel oil and electricity costs posted corresponding increases of 11.3% and 6.9% over the previous 12-month period. Prices for new vehicles and gasoline rose just 0.6% and 0.9%, respectively, year-over-year. Core inflation, as measured by the CPI for all items less food and energy, was up by a lower-than-expected margin of 2.6% over the previous 12-month period ending in November―a decline from the 3.0% rate in September.

According to the initial estimate from the Department of Commerce, U.S. gross domestic product (GDP) expanded at an annual rate of 4.3% in the third quarter of 2025—higher than the 3.8% gain in the second quarter and significantly exceeding expectations. The upturn in the economy for the second quarter was attributable primarily to increases in consumer spending, exports, and government spending. Conversely, there was a decline in residential fixed investment (purchases of private residential structures and residential equipment that property owners use for rentals).

U.K.

The Office for National Statistics (ONS) announced that inflation in the U.K., as measured by the CPI, dipped 0.2% in November, down from the 0.4% upturn in October. The CPI advanced at an annual rate of 3.2% for the month, below the 3.6% year-over-year increase in October. Costs for transportation and furniture and household goods posted the largest declines in November, more than offsetting minimal price gains in housing and household services, and recreation and culture. Prices for education, housing and household services, and communication rose 7.6%, 5.1%, and 4,8%, respectively, over the previous 12-month period, while clothing and footwear, and furniture and household goods were down by corresponding margins of 0.6% and 0.3% for the month. Core inflation, as represented by the CPI excluding energy, food, alcohol, and tobacco, rose 3.2% year-over-year in October, edging down from the 3.4% annual increase in October.2

According to the revised estimate of the ONS, U.K. GDP increased 0.1% for the third quarter of 2025 (the most recent reporting period), marginally lower than the 0.2% rise for the second quarter. Output in both the services and construction sectors ticked up 0.2% over the third quarter, while the production sector saw a 0.3% decrease.3

Eurozone

Eurostat pegged inflation for the eurozone at 2.1% for the 12-month period ending in November, matching the increase in October. Costs in the services sector rose at an annual rate of 3.5% in November, slightly higher than the 3.4% advance in October. Prices for food, alcohol and tobacco increased 2.4% year-over-year in November versus the 2.5% annual upturn for the previous month, while energy prices declined 0.5% over the previous 12-month period. Core inflation, which excludes volatile energy, food, and alcohol and tobacco prices, rose at an annual rate of 2.4% in November, unchanged from the year-over-year increase in October.4

According to Eurostat’s second estimate, eurozone GDP rose 0.3% in the third quarter—an uptick from the 0.2% growth rate for the second quarter of this year—and increased 1.4% over the previous 12-month period, down modestly from the 1.6% year-over-year increase in the second quarter. The economies of Denmark, Sweden, Luxembourg, and Cyprus were the strongest performers for the third quarter, expanding 2.3%, 1.1%, 1,1%, and 0.9%, respectively. In contrast, GDP for Switzerland, Finland, and Romania contracted by corresponding margins of 0.5%, 0.3%, and 0.2% during the quarter.5

SEI’s view

Equity markets capped off a stellar year with a positive fourth quarter. Earnings continued to broaden, monetary policy continued to ease, and artificial intelligence (AI) hyper scalers continued to spend. Heightened volatility was also a theme to close out the year as data-center debt financing raised AI bubble concerns, and the U.S. government shutdown left both policymakers and investors a bit in the dark on the state of the U.S. economy.

Reflections and resolutions abound this time of year and for good reason. After all, what better time than the start of a new year to reflect on the current state of affairs in order to establish some actionable resolutions for a better way forward? In that spirit, let’s reflect on the global capital markets and establish some investor resolutions for 2026.

Reflecting on global equity markets reveals quite a few positive trends, many are likely to carry over into 2026. Earnings have been strong and expanding beyond just the mega-cap technology companies. In fact, in the U.S., roughly 85% of all companies beat earnings estimates for the third quarter—one of the highest readings in years.6 Using the S&P 500 Index as an example, while technology outpaced the other sectors, both financials and utilities also grew earnings by over 20% year-over-year during the third quarter. Earnings expectations in the new year also remain broadly positive, with all 11 sectors of the S&P 500 Index expected to report rising earnings over the past year.

In addition, we believe that both monetary and fiscal policies will remain supportive of risk assets. While global central banks are nearing the end of this most recent easing cycle, it is worth noting the substantial easing that has already taken place and the lagged effects of monetary policy, which can extend up to 24 months. Despite many central banks being on hold and Japan notably restricting policy, expectations for 2026 still include more than 70 rate cuts across the globe. In short, monetary policy will remain a tailwind for markets, particularly in the first half of the year.

Fixed-income market reflections also reveal strong trends that we see continuing into 2026. Most notably, we expect global yield curves to steepen further as monetary policy pushes short-term rates lower and debt concerns continue to boost longer-term yields. There will be plenty of wild cards, however, in the first half of the new year, which include a U.S. Supreme Court decision regarding the Trump administration’s tariffs and a new Fed Chairman, which may affect inflation and inflation expectations in the short term. Regardless, we continue to hold the view that inflation is likely to remain stubborn and above most central bank targets. Credit markets were resilient in 2025 despite some notable headline events, and we continue to expect a “bottom-up” market in 2026 that avoids broader spread widening. Corporate balance sheets remain relatively healthy, and the maturity schedule is light in 2026.

Our fixed-income investor resolutions for 2026 include 1) staying neutral duration (interest-rate sensitivity) but avoiding long-term debt and 2) remaining defensive in credit, emphasizing risk-adjusted-yields in securitised sectors such as collateralised loan obligations (CLOs).

Finally, the commodity market offered quite a bit to reflect on in 2025 as investors experienced sharp moves in both directions across many complexes. The current state of the global economy and the substantial stimulus measure we expect to see in the new year reinforce our view that investors should have strategic exposure to commodities. Therefore, for our final investor resolution for 2026, we believe that investors should maintain broad commodity exposure given the high inflation sensitivity of the market, particularly in times of positive economic growth.

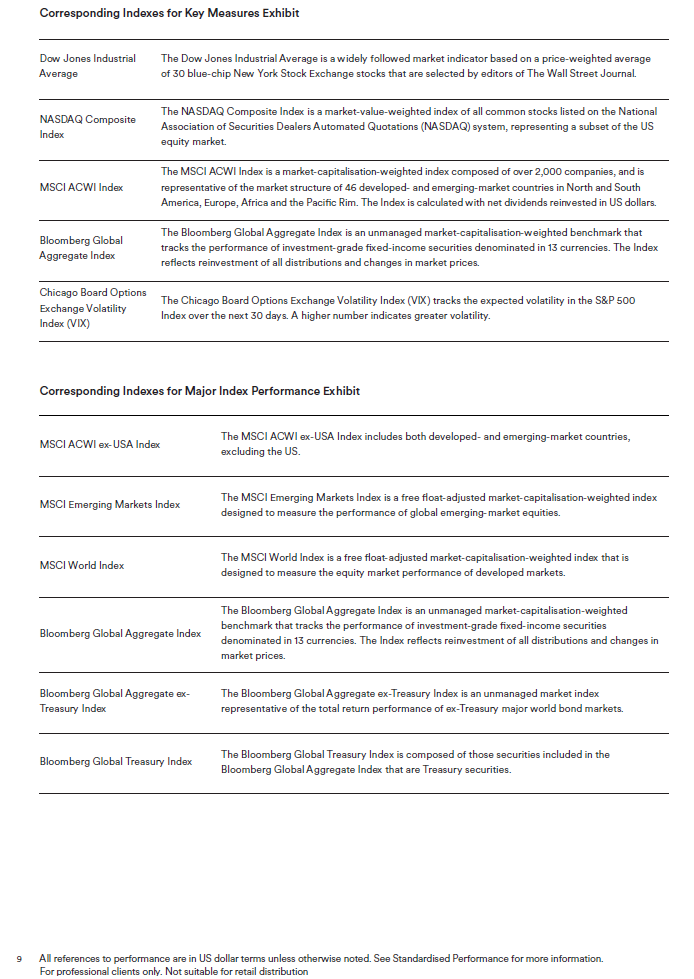

GLOSSARY AND INDEX DEFINITIONS

For financial term and index definitions, please see: seic.com/ent/imu-communications-financial-glossary

IMPORTANT INFORMATION

This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Positioning and holdings are subject to change. All information as of the date indicated.

This information should not be relied upon by the reader as research or investment advice, (unless you have otherwise separately entered into a written agreement with SEI for the provision of investment advice) nor should it be construed as a recommendation to purchase or sell a security. The reader should consult with their financial professional for more information. Statements that are not factual in nature, including opinions, projections and estimates, assume certain economic conditions and industry developments and constitute only current opinions that are subject to change without notice. Nothing herein is intended to be a forecast of future events, or a guarantee of future results.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties, which in certain cases have not been updated through the date hereof. While such sources are believed to be reliable, neither SEI nor its affiliates assumes any responsibility for the accuracy or completeness of such information and such information has not been independently verified by SEI.

There are risks involved with investing, including loss of principal. The value of an investment and any income from it can go down as well as up. Investors may get back less than the original amount invested. Returns may increase or decrease as a result of currency fluctuations. Past performance is not a reliable indicator of future results. Investment may not be suitable for everyone.

This material is not directed to any persons where (by reason of that person's nationality, residence or otherwise) the publication or availability of this material is prohibited. Persons in respect of whom such prohibitions apply must not rely on this information in any respect whatsoever.

The information contained herein is for general and educational information purposes only and is not intended to constitute legal, tax, accounting, securities, research or investment advice regarding the strategies or any security in particular, nor an opinion regarding the appropriateness of any investment. This information should not be construed as a recommendation to purchase or sell a security, derivative or futures contract. You should not act or rely on the information contained herein without obtaining specific legal, tax, accounting and investment advice from an investment professional. While considerable care has been taken to ensure the information contained within this document is accurate and up-to-date, no warranty is given as to the accuracy or completeness of any information and no liability is accepted for any errors or omissions in such information or any action taken on the basis of this information.

Index returns are for illustrative purposes only, and do not represent actual account performance. Index returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Not all strategies discussed may be available for your investment.

Information issued in the UK by SEI Investments (Europe) Ltd, 1st Floor, Alphabeta, 14-18 Finsbury Square, London EC2A 1BR which is authorised and regulated by the Financial Conduct Authority.

The contents of this document have not been reviewed by any regulatory authority in Hong Kong. You are advised to exercise caution in relation to the offer. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice.

This information is made available in Latin America and the Middle East FOR PROFESSIONAL (non-retail) USE ONLY by SIEL.

Any questions you may have in relation to its contents should solely be directed to your Distributor. If you do not know who your Distributor is, then you cannot rely on any part of this document in any respect whatsoever.

Issued in South Africa by SEI Investment (South Africa) (Pty) Limited FSP No. 13186 which is a financial services provider authorised and regulated by the Financial Sector Conduct Authority (FSCA). Registered office: 3 Melrose Boulevard, 1st Floor, Melrose Arch 2196, Johannesburg, South Africa.

SIEL is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755-1995 (the “Advice Law”) and does not carry insurance pursuant to the Advice Law. This document and any of the SEI Funds mentioned herein have not been approved by the Israeli Securities Authority (the “ISA”).

This material is intended for information purposes only and the information in it does not constitute financial advice as contemplated in terms of the Financial Advisory and Intermediary Services Act.

For professional clients only. Not suitable for retail distribution.