Christmas bargains, not Christmas cheer: Valuation discipline returns.

- Equities finished modestly higher as firmer expectations for gradual Federal Reserve (Fed) easing offset rotation away from the crowded artificial intelligence (AI) trade.

- The U.S. economy remained resilient, with consumer spending holding up and disinflation continuing unevenly.

- Outside the U.S., economic growth remained subdued: China’s recovery remained fragile, in Germany manufacturing weakness persisted, while the U.K. was stuck with persistently high inflation and low investment.

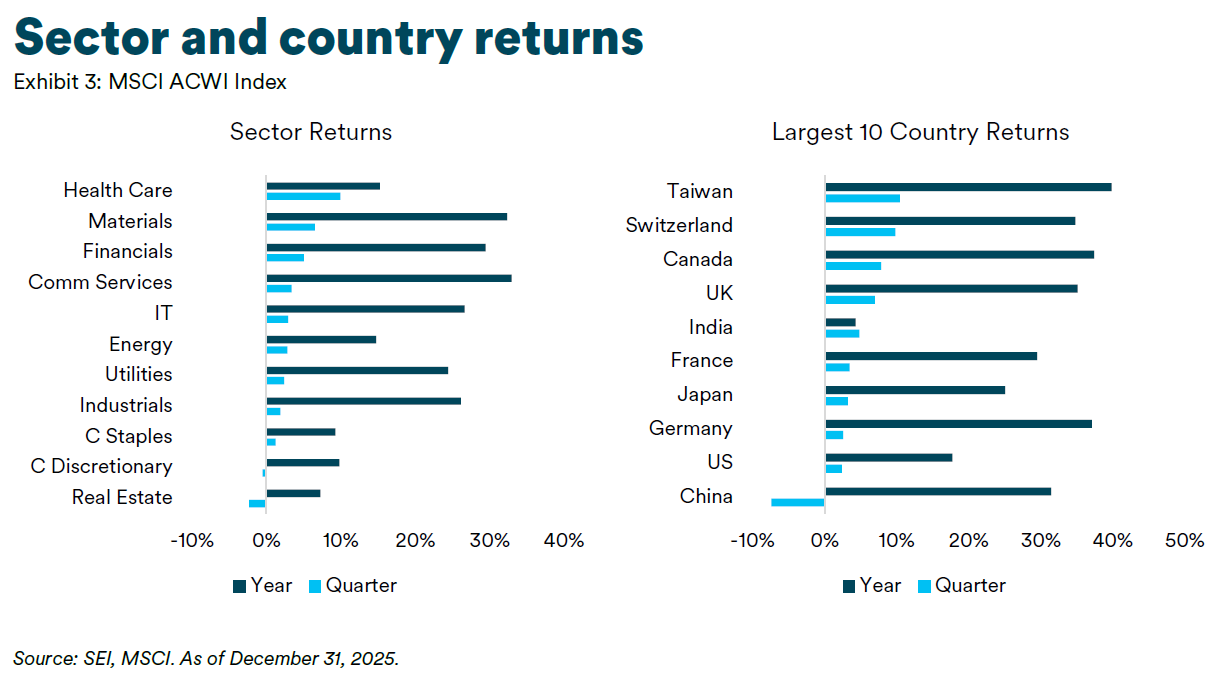

- Sector: Health Care rose on reduced uncertainty around U.S. drug pricing and a rotation away from expensive AI-linked stocks; Materials gained from a record precious metals rally, while Financials were supported by easing rate risks, lower credit concerns, and strong earnings.

- Country: Taiwan remained dominated by TSMC; Switzerland and Canada benefited from large health care names and miners respectively, with banks adding further support.

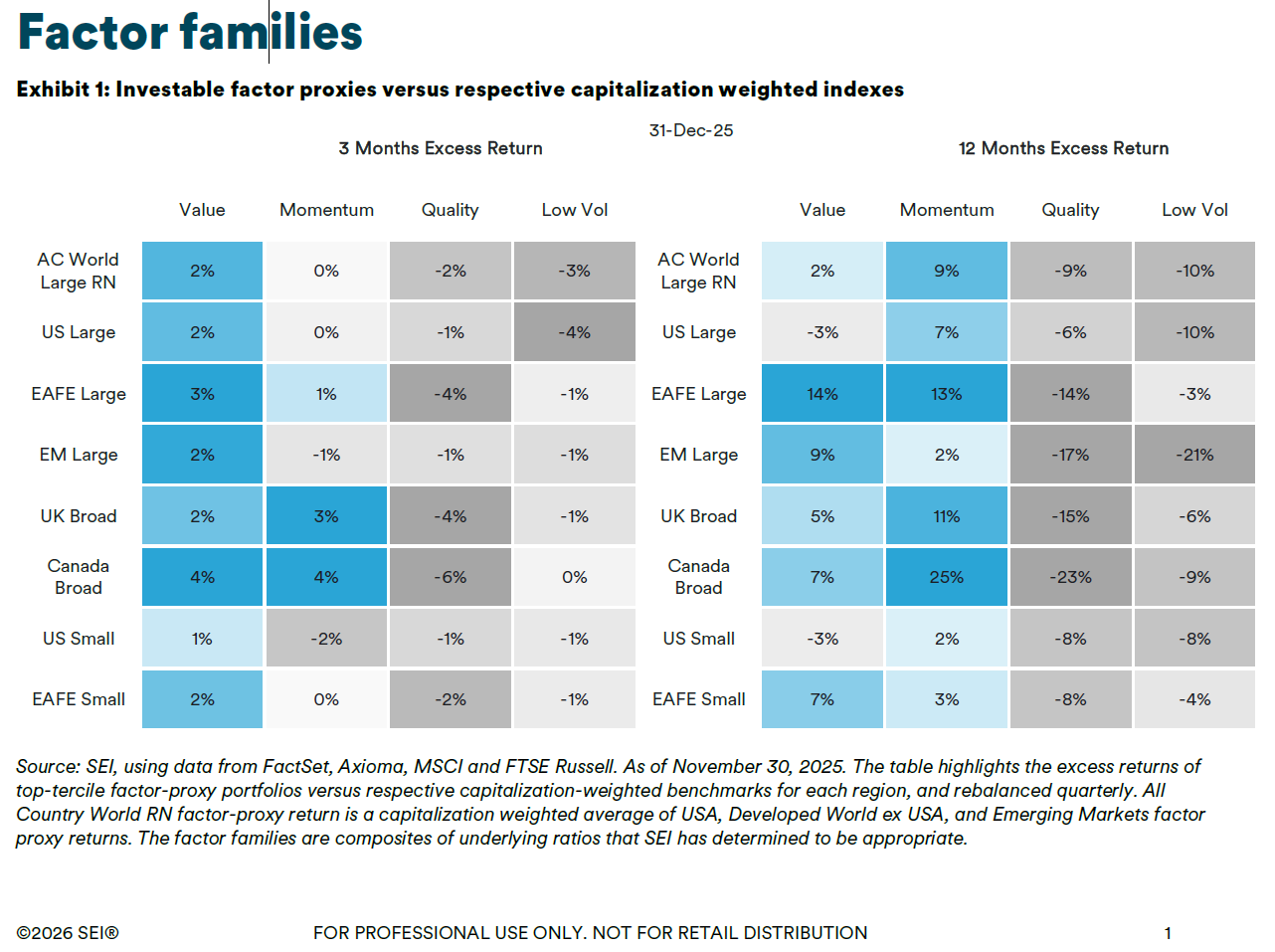

- Factor: Value outperformed, helped by both unwinding of the AI-trade and exposure to economically sensitive stocks benefiting from easing Fed and policy uncertainty.

Outlook

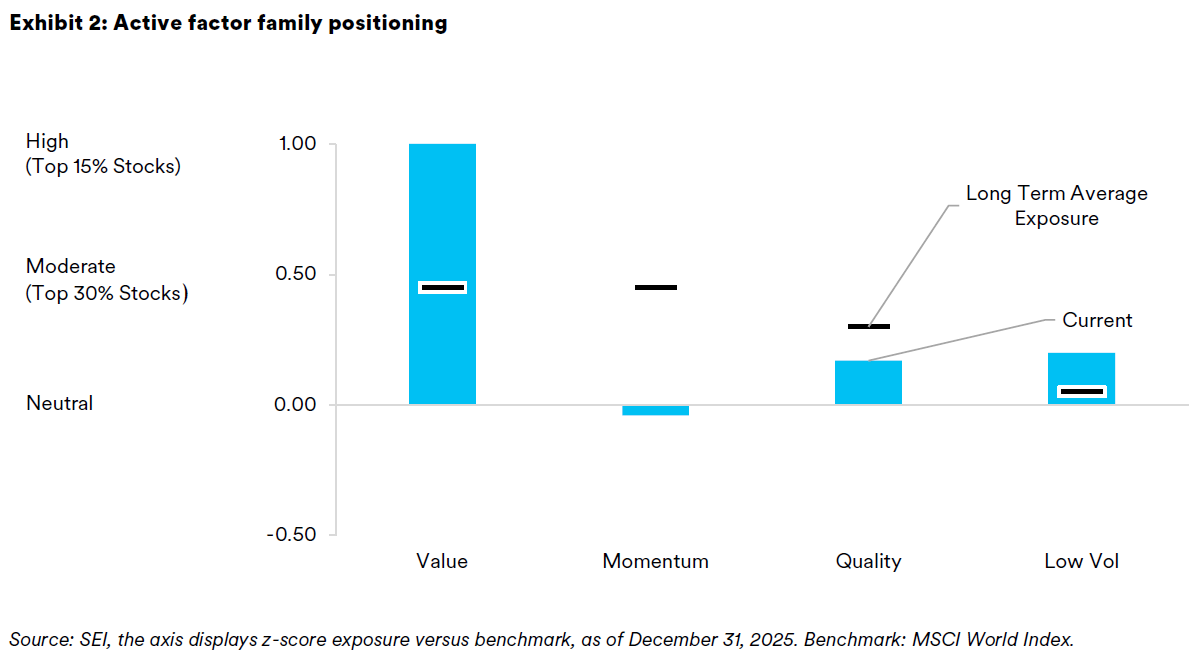

Emphasizing Value family of factors based on:

- Wide valuation spread.

- Higher long-term interest rates (versus long-term average).

Over the quarter we have:

- Maintained strong value exposure.

Economic Indicators

U.S.: Economy remained resilient, with labor holding up and disinflation continuing unevenly

Jobs: Firm, cooling at the margin

- Non-Farm Payrolls: at 64K, well above expectations and prior quarter.

- Unemployment Rate: 4.6%, above expectations and prior quarter.

- Initial Jobless Claims: 219K monthly average, below previous quarter average of 229K.

- JOLTS jobs openings: 7,670K above expectations and prior quarter 7,208K.

- ADP employment survey: -32K below expectations and prior quarter.

Inflation: Disinflation ongoing, uneven progress

- Core CPI: 2.6% (YoY), below expectations and prior quarter.

- Core PCE Deflator: 2.8% (YoY), in line with expectations but below prior quarter.

- Hourly Earnings (preliminary): 3.5% (YoY), slightly below expectations and prior quarter.

Consumer: Spending flat, sentiment weak

- Retail Sales: 0.0% (MoM, SA), below expectations and prior quarter.

- Michigan Sentiment (preliminary): 53.3, above expectations but below prior quarter.

- Consumer Confidence: 89.1, below expectations and prior quarter (pre-pandemic levels: 120-140).

Manufacturing and Services: Remained strong and in the expansion territory

- Markit PMI Manufacturing SA (preliminary): 51.8, in line with expectations and prior quarter.

- Markit PMI Services, SA (preliminary): 52.9, below expectations and prior quarter.

- Empire State Index, SA: -3.9, below expectations but above prior quarter.

The rest of the world

China: Slowing recovery, deflationary pressures persist

- Industrial Output: 4.8% (YoY), below expectations and prior quarter.

- Exports: 5.9% (YoY), well below expectations and prior readings.

- PMI manufacturing: 50.1, in line with expectations and prior quarter.

- PMI services: 52.1, in line with expectations and prior quarter.

- Retail sales: 1.3% (YoY), well below expectations and prior quarter.

- CPI: 0.7% (YoY), in line with expectations and above prior quarter.

- GDP: 4.8% (YoY), below expectations and prior quarter (last data point oct).

Japan: Inflation firm, growth subdued

- CPI Core National: 3.0% (YoY) in line.

- GDP: -0.6% (QQ), below expectations and prior quarter.

- Industrial Production: -2.3% (YoY) in November, first drop in three months.

- Manufacturing PMI: 49.7 in line.

- Services PMI: 52.5 below expectations and prior quarter.

Germany: Manufacturing contraction persists

- CPI EU Harmonized: 2.6% (YoY), in line with expectations and above prior quarter.

- Industrial Production: 1.8% (MoM), above expectations and prior quarter.

- Markit Manufacturing PMI: 42.5, below expectations and prior quarter.

- Markit Services PMI: 52.5, in line with expectations and above prior quarter.

U.K.: Inflation sticky, activity holding up

- CPI: 3.8% (YoY), slightly below expectations and prior month.

- PMI manufacturing: 51.2, above expectations and prior quarter.

- PMI services (preliminary): 52.1, in line with expectations and prior quarter.

GLOSSARY AND INDEX DEFINITIONS

For financial term and index definitions, please see: https://www.seic.com/ent/imu-communications-financial-glossary.

IMPORTANT INFORMATION

This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Positioning and holdings are subject to change. All information as of the date indicated. There are risks involved with investing, including possible loss of principal. This information should not be relied upon by the reader as research or investment advice, unless you have otherwise separately entered into a written agreement with SEI for the provision of investment advice) nor should it be construed as a recommendation to purchase or sell a security. The reader should consult with their financial professional for more information.

Statements that are not factual in nature, including opinions, projections and estimates, assume certain economic conditions and industry developments and constitute only current opinions that are subject to change without notice. Nothing herein is intended to be a forecast of future events, or a guarantee of future results.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties, which in certain cases have not been updated through the date hereof. While such sources are believed to be reliable, neither SEI nor its affiliates assumes any responsibility for the accuracy or completeness of such information and such information has not been independently verified by SEI.

There are risks involved with investing, including loss of principal. The value of an investment and any income from it can go down as well as up. Investors may get back less than the original amount invested. Returns may increase or decrease as a result of currency fluctuations. Past performance is not a reliable indicator of future results. Investment may not be suitable for everyone.

Index returns are for illustrative purposes only and do not represent actual investment performance. Index performance returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged, and one cannot invest directly in an index. Past performance does not guarantee future results.

This material is not directed to any persons where (by reason of that person's nationality, residence or otherwise) the publication or availability of this material is prohibited. Persons in respect of whom such prohibitions apply must not rely on this information in any respect whatsoever.

The information contained herein is for general and educational information purposes only and is not intended to constitute legal, tax, accounting, securities, research or investment advice regarding the strategies or any security in particular, nor an opinion regarding the appropriateness of any investment. This information should not be construed as a recommendation to purchase or sell a security, derivative or futures contract. You should not act or rely on the information contained herein without obtaining specific legal, tax, accounting and investment advice from an investment professional.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction. Our outlook contains forward-looking statements that are judgments based upon our current assumptions, beliefs, and expectations. If any of the factors underlying our current assumptions, beliefs or expectations change, our statements as to potential future events or outcomes may be incorrect. We undertake no obligation to update our forward-looking statements.

Information in the U.S. is provided by SEI Investments Management Corporation (SIMC), a wholly owned subsidiary of SEI Investments Company (SEI).

In the UK and the EEA this information issued in the UK by SEI Investments (Europe) Ltd, 1st Floor, Alphabeta, 14-18 Finsbury Square, London EC2A 1BR which is authorised and regulated by the Financial Conduct Authority. Investments in SEI Funds are generally medium- to long-term investments.

The contents of this document have not been reviewed by any regulatory authority in Hong Kong. You are advised to exercise caution in relation to the offer. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice.

This document has not been registered as a prospectus with the Monetary Authority of Singapore.

This information is made available in Latin America, the Middle East and Australia FOR PROFESSIONAL (non-retail) USE ONLY by SIEL.

Any questions you may have in relation to its contents should solely be directed to your Distributor. If you do not know who your Distributor is, then you cannot rely on any part of this document in any respect whatsoever.

Issued in South Africa by SEI Investments (South Africa) (Pty) Limited FSP No. 13186 which is a financial services provider authorised and regulated by the Financial Sector Conduct Authority (FSCA). Registered office: 3 Melrose Boulevard, 1st Floor, Melrose Arch 2196, Johannesburg, South Africa.