Stock Prices Slide as Market Volatility Returns

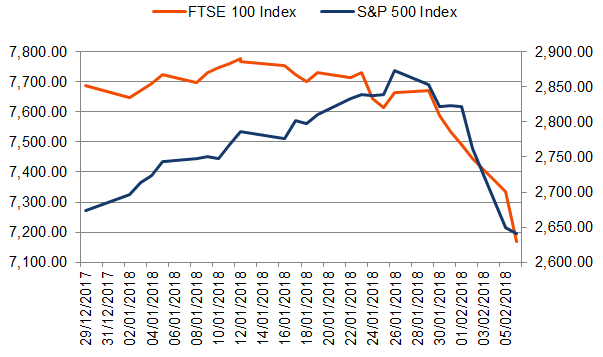

January ended with a moderate decline in the FTSE 1000 Index that quickly became a rout in February as volatility returned with a vengeance. A decline in the US served as a catalyst to push global markets lower. Exhibit 1 tracks the drop.

the drop.

Exhibit 1: The World Falls in Lockstep

Source: Bloomberg

The declines have put many investors on edge. While economists and professional investors debate whether this is merely a short pause in the market’s long upward trajectory or the beginning of an extended downturn, investors worry about losses in their portfolios. We have said for some time that a market pullback in the US would not be unexpected given the tremendous gains in stock prices in recent years. We do not think the pullback indicates risk of a US recession nor do we think it heralds a fundamental change in the global economy. It is also important to view the decline from the proper perspective.

Down but Hardly Record-Breaking

Despite the intense media focus on the size and speed of the decline, the pullback is rather unremarkable in terms of its actual size. Exhibit 2 puts the numbers in perspective.

Exhibit 2: A Fairly Typical Slide

|

S&P 500 |

FTSE 100 |

||

|

From peak* |

-7.80% |

-5.70% |

|

|

Monday** 1-day |

-4.10% |

-1.46% |

|

|

Monday** 1-week |

-7.17% |

-4.39% |

|

|

YTD |

-0.92% |

-4.59% |

|

|

*S&P 500 peak |

26/01/18 |

||

|

*FTSE 100 peak |

12/01/18 |

||

**05/02/2018

Source: Bloomberg. As at 05/02/2018

(Performance data in local currency)

What’s Moving the Market?

Following an extended period in which the US Federal Reserve (Fed) supported economic recovery by maintaining historically low benchmark interest rates, the US economy and most major economies around the world have regained strength and the labour market has tightened to levels consistent with full employment. The introduction of tax cuts, coupled with increasing wage gains, raised concerns over higher inflation expectations and the possibility that the Fed would be forced to raise interest rates more quickly than expected—causing the first notable market contraction in US markets in about two years to take place on Friday, February 2. The selloff continued on Monday, February 5, erasing year-to-date gains for major equity indices across the globe.

Our View

Investors have enjoyed a long period of relative calm in financial markets, making the return of market volatility an unwelcomed interruption. Although volatility can be unsettling, we’ve seen it before. Market movements of 2% or more have been frequent occurrences at various periods in the past, and declines of 10% or more have historically occurred about every two years.

US corrections generally last around three months and, despite their regularity, the average annual return for the S&P 500 Index over the last 50 years has been 10.05% in US dollar terms (as of 31/12/2017)[1]. Whether or not the current decline will become a correction is anyone’s guess.

Predicting the direction of short-term market movements is, at best, more art than science. In our view, putting energy into developing and maintaining an investment plan that is designed to help you achieve your goals within a timeframe and level of risk of your choosing is a more prudent approach. This is the foundation of SEI’s goals-based investment strategy. The objective is to create diversified portfolios designed to provide more consistent returns over time.

[1]Source: Professor Aswath Damoradan, NYU Stern School, http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/histretSP.html

Index Standardised Returns

|

1 year to |

1 year to |

1 year to |

1 year to |

1 year to |

|

|

31-Dec-17 |

31-Dec-16 |

31-Dec-15 |

31-Dec-14 |

31-Dec-13 |

|

|

S&P 500 Index (USD) |

21.83% |

11.96% |

1.38% |

13.69% |

32.39% |

|

FTSE 100 Index (GBP) |

11.95% |

19.07% |

-1.32% |

0.74% |

18.66% |

Data represents past performance. Past performance is not a reliable indicator of future results.

Important Information

This material is not directed to any persons where (by reason of that person's nationality, residence or otherwise) the publication or availability of this material is prohibited. Persons in respect of whom such prohibitions apply must not rely on this information in any respect whatsoever. Investment in the funds or products that are described herein are available only to intended recipients and this communication must not be relied upon or acted upon by anyone who is not an intended recipient.

While considerable care has been taken to ensure the information contained within this document is accurate and up-to-date, no warranty is given as to the accuracy or completeness of any information and no liability is accepted for any errors or omissions in such information or any action taken on the basis of this information.

SEI Investments (Europe) Limited (“SIEL”) acts as distributor of collective investment schemes which are authorised in Ireland pursuant to the UCITS regulations and which are collectively referred to as the “SEI Funds” in these materials. These umbrella funds are incorporated in Ireland as limited liability investment companies and are managed by SEI Investments Global, Limited, an affiliate of the distributor. SIEL utilises the SEI Funds in its asset management programme to create asset allocation strategies for its clients. Any reference in this document to any SEI Funds should not be construed as a recommendation to buy or sell these securities or to engage in any related investment management services. Recipients of this information who intend to apply for shares in any SEI Fund are reminded that any such application must be made solely on the basis of the information contained in the Prospectus (which includes a schedule of fees and charges and maximum commission available). Commissions and incentives may be paid and if so, would be included in the overall costs.) A copy of the Prospectus can be obtained by contacting your SEI Relationship Manager or by using the contact details shown below.

Data refers to past performance. Past performance is not a reliable indicator of future results. Investments in SEI Funds are generally medium- to long-term investments. The value of an investment and any income from it can go down as well as up. Returns may increase or decrease as a result of currency fluctuations. Investors may get back less than the original amount invested. SEI Funds may use derivative instruments which may be used for hedging purposes and/or investment purposes. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events.

In addition to the usual risks associated with investing, international investments may involve risk of capital loss from unfavourable fluctuation in currency values, from differences in generally accepted accounting principles or from economic or political instability in other nations. Securities focusing on a single country typically exhibit higher volatility.

Issued by SIEL 1st Floor, Alphabeta, 14-18 Finsbury Square, London EC2A 1BR, United Kingdom. This document and its contents are directed only at persons who have been categorised by SIEL as a Professional Client for the purposes of the FCA Conduct of Business Sourcebook. SIEL is authorised and regulated by the Financial Conduct Authority.

SEI sources data directly from FactSet, Lipper, and BlackRock, unless otherwise stated.