Risk Management: The Intelligent Pursuit of Risk

In most facets of life, we tend to associate risk with downsides: the risk of injury from slipping on ice; the risk of perishing in a plane crash; the risk of property damage from a flood. Risk, simply put, is something to be avoided.

As investors, however, risk is something to be actively, yet intelligently, pursued. Striking the right balance of specific risk exposures — with the goal of increasing returns, both at the asset class and overall portfolio levels — may not only mean increased returns in favourable environments, but also limited losses during unfavourable ones.

For example, stocks tend to experience material losses when the equity market drops; we call this equity market risk. Investors are still willing to own stocks despite such volatility because stocks have historically delivered elevated annualized returns.

Bond investors may be familiar with credit risk, which is essentially a measure of how likely a borrowing company or government will be to make their interest and principal payments. High yield bonds offer more income than investment grade bonds to compensate for greater credit risk exposure.

Interest rates are also important in fixed income analysis; a bond’s price will typically decline when prevailing market rates increase, since the fixed interest rate paid by the bond becomes comparably less attractive. All else equal, a bond that matures in a year will be less sensitive to that change, and therefore exhibit less interest rate risk, than a bond that matures in ten years. Longer-term bonds typically offer higher fixed rates so that investors will purchase them even with the knowledge of their sensitivity to interest rates.

Risk Management Does Not Equal Risk Aversion

While seeking risk is an important aspect of pursuing investment goals, it can be a difficult practice for many investors. Studies show that investors feel the pain of an investment loss much more acutely than the joy of a gain — and therefore tend to be disproportionally risk averse in relation to their expected outcomes. (See our Behavioural Finance series.)

In other words, the act of pursuing and maintaining risk exposure runs against investors’ instinct to prevent capital loss, however temporary. As such, risk management not only works toward minimizing risk exposures that we believe may fail to adequately compensate investors, but also encourages risk exposures that we believe are more likely to be rewarded.

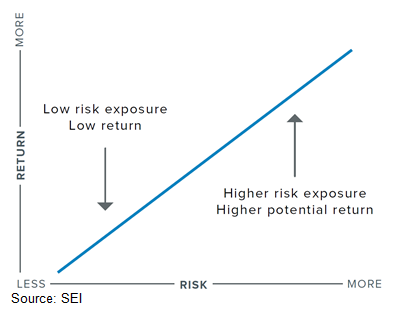

Exhibit 1: The tradeoff between risk and return

As goals-based investing adherents, we believe the greatest risk facing investors lies in the failure to achieve their objectives and cover future liabilities. Therefore, we seek risk exposures that we believe will help increase returns to help our investors achieve their goals.

Our Culture and Principles

Even the most skilled investors can use help maintaining objectivity when balancing risk exposures. We therefore believe it’s important to separate portfolio management from risk oversight, as we do in SEI’s Investment Management Unit.

Our risk management team operates autonomously, decomposing every security and portfolio down to a set of risks (or, in more technical terms, systematic economic and market factors that explain the variability of a security’s historical returns). This risk model helps us answer several questions:

- Are the risk factors consistent with the fund or strategy’s mandate?

- Is their presence intentional?

- Do they represent excessive exposures?

This is not to say that our portfolio managers and analysts are not also responsible for monitoring and managing risk budgets. While our risk management team conducts analysis independently, it is also tasked with educating our investment teams about risk sources and metrics. We are each risk managers in this sense. This shared understanding and responsibility forms the basis of our culture.

Risk Management: Measurement to Goals

To learn more about our approach to risk management, stay tuned for a series of forthcoming papers. Specifically, we plan to address the following, in terms of their contributions to risk management:

- Setting a risk-management framework

- Measuring and monitoring risk

- Investment manager research and due diligence

- Asset allocation and constructing portfolios

- Balancing risk for goals-based investing

Important Information

There is no guarantee the strategies discussed will achieve their intended results. Diversification does not ensure a profit or guarantee against a loss.

Past performance is not a guarantee of future performance.

Investments in SEI Funds are generally medium to long term investments. The value of an investment and any income from it can go down as well as up. Investors may not get back the original amount invested. Additionally, this investment may not be suitable for everyone. If you should have any doubt whether it is suitable for you, you should obtain expert advice.

No offer of any security is made hereby. Recipients of this information who intend to apply for shares in any SEI Fund are reminded that any such application may be made solely on the basis of the information contained in the Prospectus. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding the funds or any stock in particular, nor should it be construed as a recommendation to purchase or sell a security, including futures contracts.

In addition to the normal risks associated with equity investing, international investments may involve risk of capital loss from unfavourable fluctuation in currency values, from differences in generally accepted accounting principles or from economic or political instability in other nations. Bonds and bond funds are subject to interest rate risk and will decline in value as interest rates rise. High yield bonds involve greater risks of default or downgrade and are more volatile than investment grade securities, due to the speculative nature of their investments. Narrowly focused investments and smaller companies typically exhibit higher volatility. SEI Funds may use derivative instruments such as futures, forwards, options, swaps, contracts for differences, credit derivatives, caps, floors and currency forward contracts. These instruments may be used for hedging purposes and/or investment purposes.

While considerable care has been taken to ensure the information contained within this document is accurate and up-to-date, no warranty is given as to the accuracy or completeness of any information and no liability is accepted for any errors or omissions in such information or any action taken on the basis of this information.

This information is issued by SEI Investments (Europe) Limited, 1st Floor, Alphabeta, 14-18 Finsbury Square, London EC2A 1BR which is authorised and regulated by the Financial Conduct Authority. Please refer to our latest Full Prospectus (which includes information in relation to the use of derivatives and the risks associated with the use of derivative instruments), Key Investor Information Documents and latest Annual or Semi-Annual Reports for more information on our funds. This information can be obtained by contacting your Financial Advisor or using the contact details shown above.