Risk Management: Governance, Culture and Technology

Our introductory paper, Risk Management: The Intelligent Pursuit of Risk, provided a glimpse of the qualifying framework used by the risk management team in SEI’s Investment Management Unit (IMU):

- Are risk factors consistent with the fund or strategy’s mandate?

- Is their presence intentional?

- Do they represent excessive exposures?

These questions provide a clear basis for measuring risk, which is a result of the assertive role that risk management plays throughout the entire investment management cycle ―from the proposal of a new investment strategy to the ongoing monitoring of SEI’s funds and portfolio strategies.

IMU risk management’s process draws on three key strengths: governance, culture and technology.

Governance

The IMU’s structure reflects the fact that separating risk oversight from portfolio management improves objectivity. As an independent team, the head of risk management serves as a member of the Investment Strategy Oversight (ISO) Committee, which includes the head of the IMU, as well as the heads of portfolio management, manager research, portfolio strategies, operations and the chief compliance officer of SEI Investments Management Corporation.

ISO is charged with guiding and approving new strategies, along with the guidelines that determine risk policies such as tracking error and leverage limits. The decisions made at this stage have a direct impact on how we answer the three questions that form our risk measurement framework.

When predetermined thresholds limits are exceeded, risk management reports the status change to ISO. As changes in the portfolio can be driven by a number of factors, including market movements, decisions by underlying investment managers, changes in benchmark indexes, and others, each requires an event-specific evaluation and reaction.

Accordingly, ISO consults with the portfolio manager to review and evaluate the underlying factors that drove the change. The committee has ultimate responsibility to review and approve the portfolio manager’s recommendations on the best way to adjust the portfolio so that the risk budget moves back into alignment. This process may involve several rounds of discussion in order to reach an outcome designed to achieve both the portfolio’s investment goals and its risk objectives.

Culture

A shared understanding between the risk management team and portfolio managers regarding risk sources, risk budgets and risk metrics helps cultivate a sense of joint responsibility.

Those agreed-upon risk guidelines determine how risk management evaluates the strategies, and also provide parameters to the portfolio managers that, in effect, enable them to serve as proactive risk managers themselves.

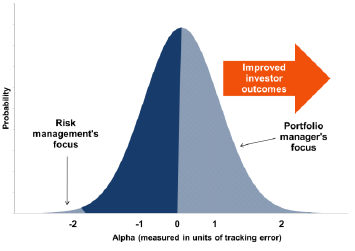

Frequent interaction between risk management and portfolio management, as well as the transparency of working with a shared risk model, enables them to serve effectively as complements. Picture a distribution curve representing a range of potential investment outcomes. A portfolio manager seeks to move the entire curve to the right; that is, to increase instances of positive investment performance. The risk manager seeks to manage the left tail, or reduce instances of deeply negative performance. They work together in an effort to improve the investment experience.

Exhibit 1: Working Together

Technology

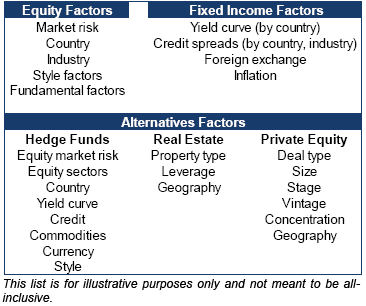

Our risk model ―a multi-asset platform that provides a consistent view of risk across equities, fixed-income and alternatives ―serves as a shared resource that enables our monitoring and measurement efforts.

This platform maps each security to a set of risk factors based on daily information generated by our accounting system. These economic and market variables help explain the variability of a security’s return. For example, government bond returns can typically be explained by interest rate movements, while corporate bond returns are more likely to be explained by both rates and credit spreads (credit spreads are the difference in yield between government and non-government bonds).

Factors are often associated with or more prominent in one asset class than others, but they can transcend traditional asset class boundaries. Consider that financial stocks, mortgage-backed securities and bank loans belong to separate asset classes, but share common risk factors.

Exhibit 2: Common Risk Factors

We aggregate the information derived from our factor analysis to determine the contributions to risk from a given factor, at the fund or portfolio level, and from each investment manager. The latter carries a high degree of importance in a manager-of-managers context. Just as each fund is assigned an overall risk budget, our portfolio managers seek to ensure the managers within their funds adhere to manager-specific risk budgets. This process prevents a single manager from dominating the portfolio’s risk allowance.

Risk Management: Monitoring and Measurement

Our series on SEI’s approach to risk management will continue with a paper detailing how we employ our risk modelling technology to monitor and measure risk ―at the security, manager, fund and portfolio levels. We also plan to address the following, in terms of their contributions to risk management, over the coming months:

- Investment manager research and due diligence

- Asset allocation and constructing portfolios

- Balancing risk for goals-based investing

Glossary

Alpha: Alpha refers to returns in excess of the benchmark.

Leverage: Leverage refers to the degree to which an investor or company is using borrowed money to finance activities. For example, a highly leveraged company would have a significant amount of debt relative to its equity. Leverage can help increase returns, but can also increase risk in that it may be more difficult to make payments on debt.

Mortgage-backed securities: Mortgage-backed securities are made up of multiple mortgages packaged together into single securities. These can be comprised of commercial or residential mortgages. Agency means that the debt is guaranteed by a government-sponsored entity, while non-agency means that it is not.

Tracking error: Tracking error refers to how closely the returns of a fund or portfolio follow its benchmark (usually an index). If tracking error is measured historically, it is called or ex-post tracking error. If a model is used to predict future tracking error, it is called ex-ante tracking error.

Yield curve: The yield curve represents differences in yields across a range of maturities of bonds of the same issuer or credit rating (likelihood of default). A steeper yield curve represents a greater difference between the yields. A flatter curve indicates the yields are closer together.

Important Information

Past performance is not a guarantee of future performance.

Investments in SEI Funds are generally medium to long term investments. The value of an investment and any income from it can go down as well as up. Investors may not get back the original amount invested. Additionally, this investment may not be suitable for everyone. If you should have any doubt whether it is suitable for you, you should obtain expert advice.

No offer of any security is made hereby. Recipients of this information who intend to apply for shares in any SEI Fund are reminded that any such application may be made solely on the basis of the information contained in the Prospectus. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding the funds or any stock in particular, nor should it be construed as a recommendation to purchase or sell a security, including futures contracts.

In addition to the normal risks associated with equity investing, international investments may involve risk of capital loss from unfavourable fluctuation in currency values, from differences in generally accepted accounting principles or from economic or political instability in other nations. Bonds and bond funds are subject to interest rate risk and will decline in value as interest rates rise. High yield bonds involve greater risks of default or downgrade and are more volatile than investment grade securities, due to the speculative nature of their investments. Narrowly focused investments and smaller companies typically exhibit higher volatility. SEI Funds may use derivative instruments such as futures, forwards, options, swaps, contracts for differences, credit derivatives, caps, floors and currency forward contracts. These instruments may be used for hedging purposes and/or investment purposes.

While considerable care has been taken to ensure the information contained within this document is accurate and up-to-date, no warranty is given as to the accuracy or completeness of any information and no liability is accepted for any errors or omissions in such information or any action taken on the basis of this information.

This information is issued by SEI Investments (Europe) Limited ("SIEL"), 1st Floor, Alphabeta, 14-18 Finsbury Square, London EC2A 1BR which is authorised and regulated by the Financial Conduct Authority. Please refer to our latest Full Prospectus (which includes information in relation to the use of derivatives and the risks associated with the use of derivative instruments), Key Investor Information Documents and latest Annual or Semi-Annual Reports for more information on our funds. This information can be obtained by contacting your Financial Advisor or using the contact details shown above.

SIEL is the distributor of the SEI UCITS Funds and provides the distribution and placing agency services to the Funds by appointment from the manager of the Funds, namely SEI Investments Global, Limited, a company incorporated in Ireland ("SIGL"). SIGL has in turn appointed SEI Investments Management Corporation ("SIMC"), a US corporation organised under the laws of Delaware and overseen by the US federal securities regulator, as investment adviser to the Funds. SIMC provides investment management and advisory services to the Funds. SIEL, SIGL and SIMC are wholly owned subsidiaries of SEI Investments Company.