Oh Snap! UK Election Surprises

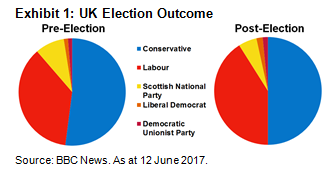

Conservatives lost 13 seats in the election, eliminating the party’s parliamentary majority, which was the reverse of their intention when Prime Minister Theresa May called a snap election in early April. Conservatives appear likely to form a coalition government with the Democratic Unionist Party (DUP) of Northern Ireland.

Labour gained 30 seats, so it will wield more power in opposing enactment of the Conservative agenda. The Scottish National Party suffered the greatest losses (21 seats), laying to rest the issue of another referendum on Scottish independence for now.

Exhibit 1: UK Election Outcome

A Softened Hard Line

Prime Minister May now leads from a substantially weaker position, and while she has expressed no intention to resign, it may only be a matter of time before her party chooses a replacement. It’s entirely possible that timeframe could include the full scope of Brexit negotiations.

Ahead of the election, Prime Minister May had promoted a willingness to pursue a hard-line break from the EU if a good deal could not be negotiated. That hard Brexit outcome is now in question.

Indeed, voters appeared to project a preference for a softer Brexit. The election dealt a significant blow to a small-but-influential number of conservative hard-line Brexit proponents. The relative shift in fortunes between anti-austerity Labour (which has espoused a preference for soft Brexit and an increase in social welfare programs) and austerity-minded Conservatives reinforces this point.

Market Reaction

Markets took the result in stride as at 9 June 2017. Granted, polling partially prepared investors for this outcome as it showed Conservatives move from a substantial lead (and the likelihood of an expanded majority) to a tighter race (and a greater-but-still-small probability of the realized outcome).

Sterling fell against most currencies but seems to have stabilised. Gilts were largely unaffected. UK stocks were down only slightly, while most European bourses were positive.

SEI’s View

These election results may have delayed the increase in certainty that would have accompanied an enhanced Conservative majority. But the market reaction suggests that the outcome was not unpalatable to investors.

The UK has essentially traded one type of uncertainty for another: the risk of economic and political rupture with the EU has gone down, while the risk of domestic political dysfunction and paralysis has increased.

Importantly, the continued uncertainty contains an upside. The probability of a softer, more business-friendly Brexit has increased, which is an improvement. The maintenance of economic and political ties between the UK and EU would be a positive development for UK service industries and the City of London.

Soft Brexit is still not a certainty. The EU will help dictate the final outcome and it’s possible, if not likely, that Prime Minister May could entice the DUP to tolerate a Hard Brexit with political bequests.

Important Information

Past performance is not a guarantee of future performance.

Investments in SEI Funds are generally medium to long term investments. The value of an investment and any income from it can go down as well as up. Investors may not get back the original amount invested. Additionally, this investment may not be suitable for everyone. If you should have any doubt whether it is suitable for you, you should obtain expert advice.

No offer of any security is made hereby. Recipients of this information who intend to apply for shares in any SEI Fund are reminded that any such application may be made solely on the basis of the information contained in the Prospectus. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding the funds or any stock in particular, nor should it be construed as a recommendation to purchase or sell a security, including futures contracts.

In addition to the normal risks associated with equity investing, international investments may involve risk of capital loss from unfavourable fluctuation in currency values, from differences in generally accepted accounting principles or from economic or political instability in other nations. Bonds and bond funds are subject to interest rate risk and will decline in value as interest rates rise. High yield bonds involve greater risks of default or downgrade and are more volatile than investment grade securities, due to the speculative nature of their investments. Narrowly focused investments and smaller companies typically exhibit higher volatility. SEI Funds may use derivative instruments such as futures, forwards, options, swaps, contracts for differences, credit derivatives, caps, floors and currency forward contracts. These instruments may be used for hedging purposes and/or investment purposes.

While considerable care has been taken to ensure the information contained within this document is accurate and up-to-date, no warranty is given as to the accuracy or completeness of any information and no liability is accepted for any errors or omissions in such information or any action taken on the basis of this information.

This information is issued by SEI Investments (Europe) Limited, 1st Floor, Alphabeta, 14-18 Finsbury Square, London EC2A 1BR which is authorised and regulated by the Financial Conduct Authority. Please refer to our latest Full Prospectus (which includes information in relation to the use of derivatives and the risks associated with the use of derivative instruments), Key Investor Information Documents and latest Annual or Semi-Annual Reports for more information on our funds. This information can be obtained by contacting your Financial Advisor or using the contact details shown above.

SEI sources data directly from Factset, Lipper, and BlackRock.