Manager Announcement: Portfolio Enhancement Summary - Q1 2016

Fund Enhancement Summary

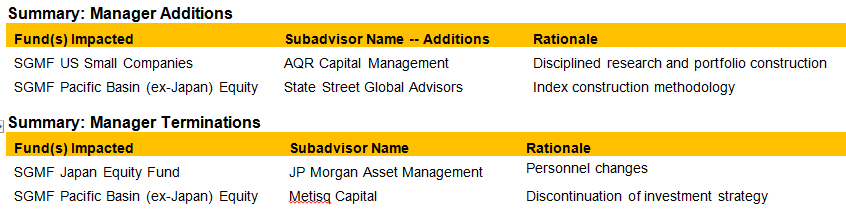

The following is a summary of SEI Global Master Fund (SGMF) manager changes, the rationale behind these changes and an overview of the new managers. For greater detail on the rationale for each change, please refer to individual manager change memos.

AQR Capital Management (AQR)

Overview

AQR is an independently owned investment management firm located in Greenwich, Connecticut. The firm was founded in 1998 by four principals ― Clifford Asness, David Kabiller, Robert Krail, and John Liew ― all formerly of Goldman Sachs Asset Management. As of December 31, 2015, AQR has 617 employees and $141.4 billion in assets under management.

Philosophy

The investment professionals at AQR consider themselves fundamental investors who employ quantitative tools to maintain a diversified portfolio. They believe that their basic “value” and “momentum” philosophy, combined with extensive efforts to minimise transaction costs and incorporate disciplined risk control, will lead to attractive long-term results.

Process

AQR’s ideas come from a wide range of sources including academic and industry research, current events and daily market movements. The most important criteria behind a proposed trading strategy are a strong economic or behavioural rationale for why the opportunity exists and why it may persist. Stock selection views are designed to be industry-neutral, and each stock is ranked on its attractiveness relative to its industry group as a whole. A small part of the portfolio’s total active risk is given to industry views. Each industry is ranked relative to other industries using industry-wide fundamental indicators. The final aggregate view, which is a combination of all underlying investment criteria, contains a weight assigned to each stock, which is a cumulative measure of its overall attractiveness. AQR trades electronically through direct connections to exchanges in all markets where this option exists.

State Street Global Advisors (SSGA)

Overview

State Street Global Advisors Inc. was established in 1978 as an affiliate of State Street Bank & Trust Co. and is a wholly-owned subsidiary of State Street Corporation. SSGA currently manages $2.48 trillion.

Philosophy

SSGA seeks to efficiently provide market exposure across equity and fixed-income via index replication strategies. Security-selection decisions are driven by index constituents, and the firm’s process allows quick and efficient identification of risks, such as differences that arise from changes to the benchmark. This benefits strategy implementation as smart security selection can add value by reducing transaction costs without compromising the integrity of the portfolio. The firm’s size and market presence also serve as leverage to gain lower transaction costs, as well as attractive pricing and execution.

Process

SSGA begins with the securities contained within an Index at the time of construction. The replication process is done with the intention of mimicking the index as closely as possible. Changes to the index such as new issuance, downgrades and index rule updates are analyzed on a case-by-case basis. Investment team members meet with traders to plan for upcoming changes and issues such as security liquidity and supply versus demand. Portfolios are monitored daily and exposures are reported to review holdings for sources of index deviation. There will be instances where the portfolio manager will enter a position in a security prior to index changes or corporate actions in an effort to add value, although they are careful to maintain tight tracking error to the index. While the strategies hold every security in a given benchmark index, there will be slight deviation on a daily basis as perfectly matching weights would incur significant trading costs. Instead, deviations are continually brought back into line through cash flow adjustments.

Glossary

- Fundamental: Fundamental analysis is based on analyst research and judgement.

- Momentum: Momentum stocks are those whose prices are expected to keep moving in the same direction (either up or down) and are not likely to change direction in the short-term.

- Quantitative: Quantitative analysis is based on computer-driven models.

Past performance is not a guarantee of future performance.

Investments in SEI Funds are generally medium to long term investments. The value of an investment and any income from it can go down as well as up. Investors may not get back the original amount invested. Additionally, this investment may not be suitable for everyone. If you should have any doubt whether it is suitable for you, you should obtain expert advice.

No offer of any security is made hereby. Recipients of this information who intend to apply for shares in any SEI Fund are reminded that any such application may be made solely on the basis of the information contained in the Prospectus. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding the funds or any stock in particular, nor should it be construed as a recommendation to purchase or sell a security, including futures contracts.

In addition to the normal risks associated with equity investing, international investments may involve risk of capital loss from unfavourable fluctuation in currency values, from differences in generally accepted accounting principles or from economic or political instability in other nations. Bonds and bond funds are subject to interest rate risk and will decline in value as interest rates rise. High yield bonds involve greater risks of default or downgrade and are more volatile than investment grade securities, due to the speculative nature of their investments. Narrowly focused investments and smaller companies typically exhibit higher volatility. SEI Funds may use derivative instruments such as futures, forwards, options, swaps, contracts for differences, credit derivatives, caps, floors and currency forward contracts. These instruments may be used for hedging purposes and/or investment purposes.

While considerable care has been taken to ensure the information contained within this document is accurate and up-to-date, no warranty is given as to the accuracy or completeness of any information and no liability is accepted for any errors or omissions in such information or any action taken on the basis of this information.

This information is issued by SEI Investments (Europe) Limited, 1st Floor, Alphabeta, 14-18 Finsbury Square, London EC2A 1BR which is authorised and regulated by the Financial Conduct Authority. Please refer to our latest Full Prospectus (which includes information in relation to the use of derivatives and the risks associated with the use of derivative instruments), Key Investor Information Documents and latest Annual or Semi-Annual Reports for more information on our funds. This information can be obtained by contacting your Financial Advisor or using the contact details shown above.