Big tech’s AI debt and “the bums problem .”

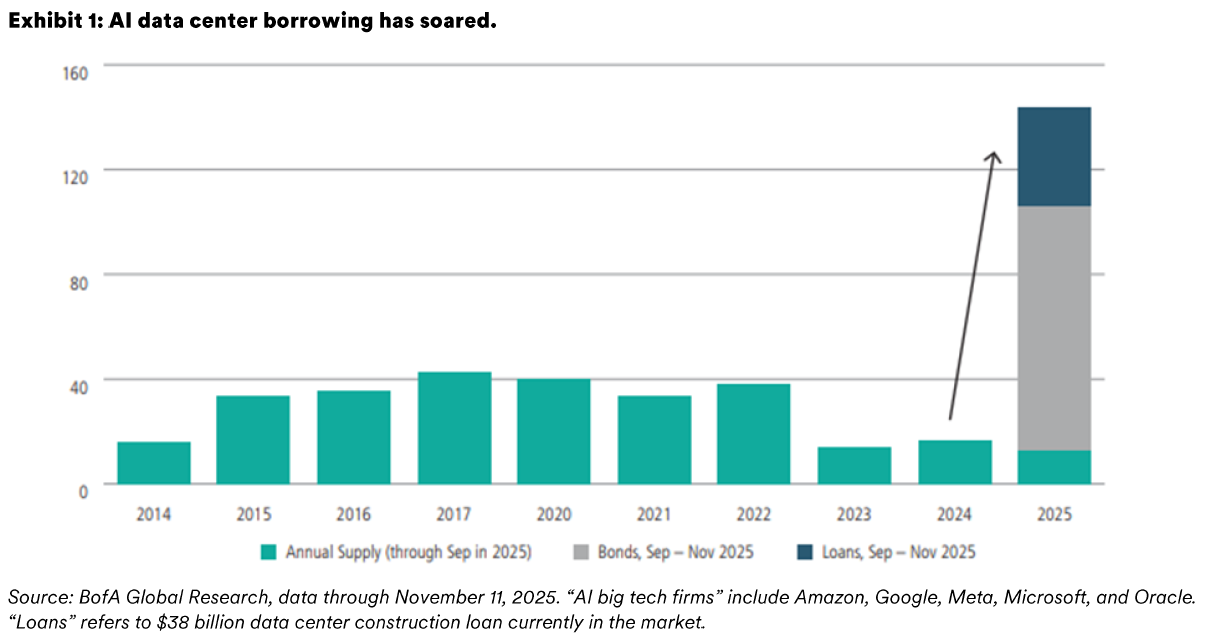

Over the last few months, artificial intelligence (AI)-related debt issuance from so-called hyperscalers (Amazon, Google, Meta, Microsoft, and Oracle) has flooded the investment-grade bond market. Historically, these firms have been largely absent from debt markets, relying instead on cash-heavy funding models for their near-term growth ambitions. As the AI race heats up, so does the debt issuance for its required development and infrastructure build. Year-to-date AI issuance has risen to over $100 billion, triple the past 10 years’ average of $32 billion annually and roughly 7% of the entire investment-grade market’s issuance thus far in 2025.

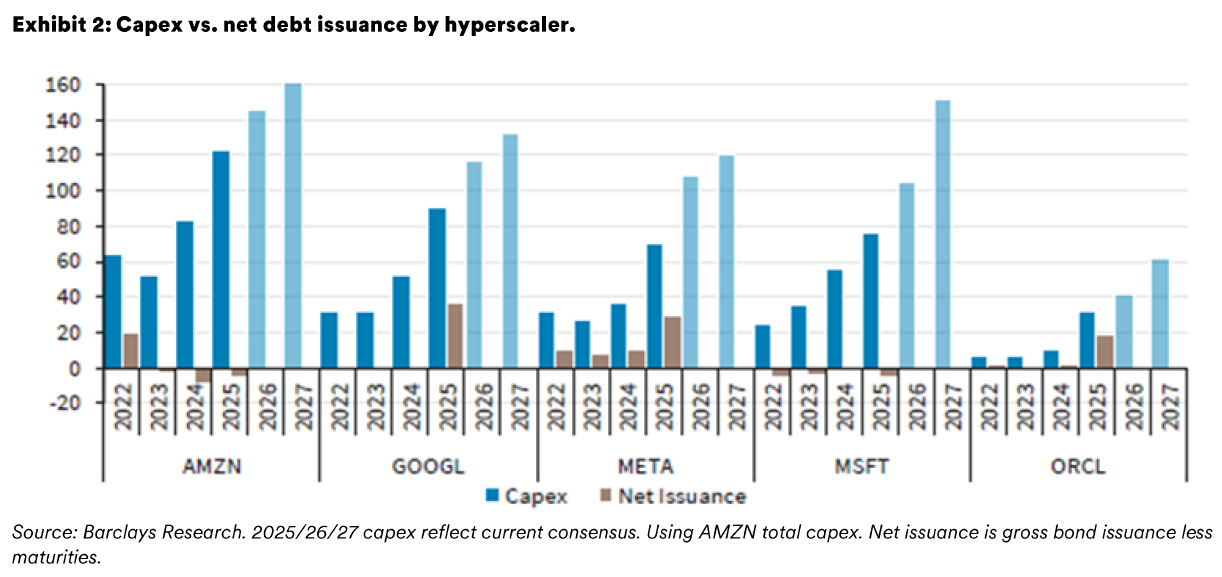

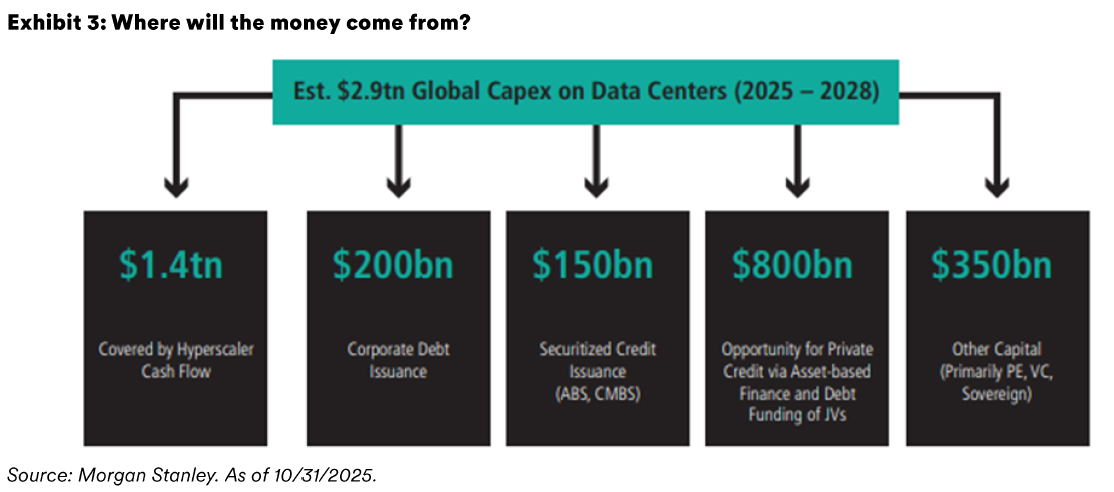

Predictions for future AI capital-expenditure (capex) spending vary, with J.P. Morgan forecasting $5 trillion in future capex, including $1.5 trillion funded from the investment-grade corporate bond market. Morgan Stanley puts the figure closer to $3 trillion in total capex, funded from a variety of sources, including the investment-grade corporate bond market. While estimates vary, the corporate debt issuance to fund AI capex will likely wind up in the hundreds of billions, if not trillions, of dollars.

This presents a challenge, particularly for passive bond investors. In traditional investment-grade benchmarks, a company’s weight increases as it issues more investment-grade debt, not because it is a better investment. This dynamic is often referred to as “the bums problem.” Active fixed-income managers carefully evaluate a company’s growing debt load, weighing the risk and return potential of each position. In contrast, passive bond funds and ETFs typically purchase these bonds to minimize tracking error, even if doing so means taking on additional credit risk. Could there be a stronger case for active fixed-income strategies?

Elevated AI debt issuance from the big tech names mentioned earlier has increased their weight in the Bloomberg U.S. Corporate Index only marginally over the past 12 months. The five companies’ current weight is 3.52%, up just 0.81% from a year prior. Nevertheless, if predictions for AI debt issuance play out, hyperscalers will likely play a larger role in investment-grade corporate bond benchmarks going forward.

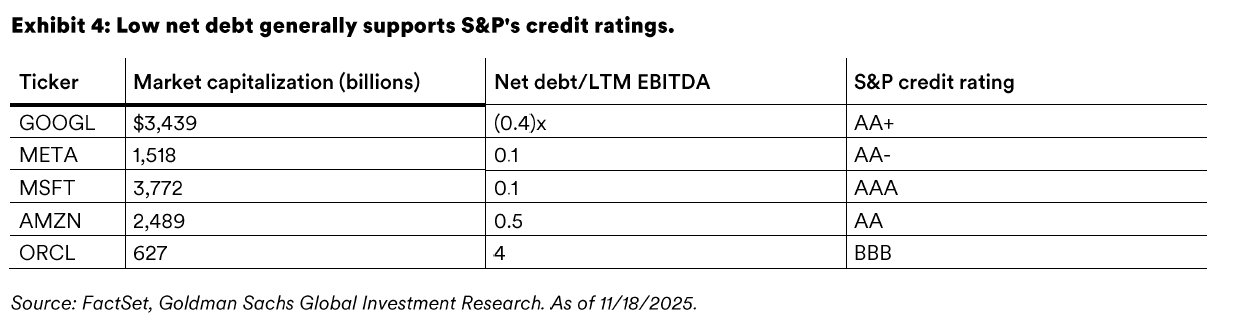

As depicted in the table above, current net debt levels among most hyperscalers are low (with a few exceptions), supporting Standard & Poor’s (S&P) high credit ratings for most of the major players. However, big tech’s recent new issuance has generally come with concessions (i.e., wider spreads than issues with identical credit ratings). Several of our investment-grade managers have responded by selectively adding positions in this big tech, AI-related debt. In some cases, managers participated in the new issues and then sold them “on the break”—strategically buying the bonds at issuance and quickly exiting for a near-term profit.

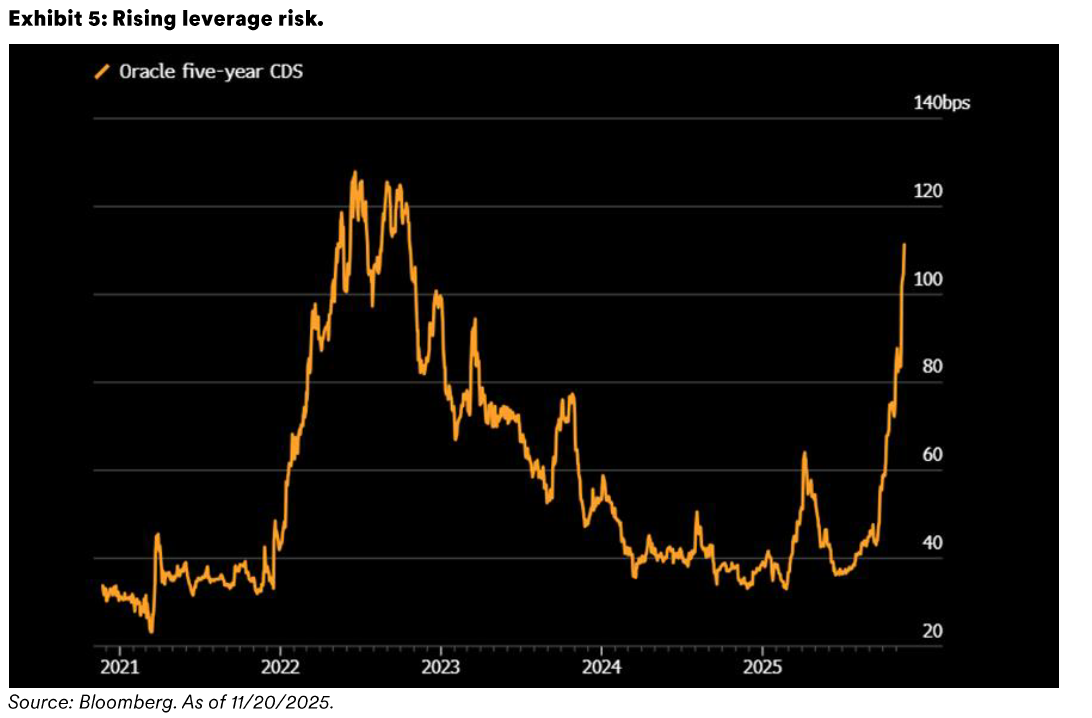

Not all hyperscalers are created equal, and while most currently have healthy balance sheets, the market has grown wary of firms like Oracle that have issued a significant amount of debt on the hope of future revenue growth (as evidenced by rising spreads for the firm’s credit default swaps, seen as a gauge for a higher likelihood that its bonds will default).

Fortunately for fixed-income investors, you are not alone in navigating the ever-changing investment landscape; selecting skillful credit managers is a feature of SEI’s multi-manager research process. We conduct deep underwriting on each manager, including evaluating their ability to prudently underwrite credit fundamentals and assess relative value in a fast-moving market.

As with all new investment opportunities, the importance of detailed analysis and a healthy level of skepticism is warranted. As big tech’s scramble to raise, spend, and grow in the AI space continues, this will create opportunities and only serve to amplify the importance of active management.

IMPORTANT INFORMATION

This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. All information as of the date indicated. There are risks involved with inv esting, including possible loss of principal. This information should not be relied upon by the reader as research or investment advice, (unless you have otherwise separately entered into a written agreement with SEI for the provision of investment advice) nor should it be construed as a recommendation to purchase or sell a security. The reader should consult with their financial professional for more information.

Statements that are not factual in nature, including opinions, projections and estimates, assume certain economic conditions and industry developments and constitute only current opinions that are subject to change without notice. Nothing herein is intende d to be a forecast of future events, or a guarantee of future results.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties, which in certain cases have not been updated through the date hereof. While such sources are believed to be reliable, neither SEI n or its affiliates assumes any responsibility for the accuracy or completeness of such information and such information has not been independently verified by SEI.

Index returns are for illustrative purposes only, and do not represent actual performance of an SEI Fund. Index returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Pas t performance does not guarantee future results.

There are risks involved with investing, including loss of principal. The value of an investment and any income from it can go down as well as up. Investors may get back less than the original amount invested. Returns may increase or decrease as a result o f currency fluctuations. Past performance is not a reliable indicator of future results. Investment may not be suitable for everyone. Diversification may not protect against market risk.

This material is not directed to any persons where (by reason of that person's nationality, residence or otherwise) the publication or availability of this material is prohibited. Persons in respect of whom such prohibitions apply must not rely on this inf ormation in any respect whatsoever.

The information contained herein is for general and educational information purposes only and is not intended to constitute legal, tax, accounting, securities, research or investment advice regarding the strategies or any security in particular, nor an opi nion regarding the appropriateness of any investment. This information should not be construed as a recommendation to purchase or sell a security, derivative or futures contract. You should not act or rely on the information contained herein without obtai ning specific legal, tax, accounting and investment advice from an investment professional.

Information in the U.S. is provided by SEI Investments Management Corporation (SIMC), a wholly owned subsidiary of SEI Investments Company (SEI).

SEI Investments Canada Company, a wholly owned subsidiary of SEI Investments Company, is the investment fund manager and portfolio manager of the SEI Funds in Canada.

Information issued in the UK by SEI Investments (Europe) Limited, 1st Floor, Alphabeta, 14 -18 Finsbury Square, London EC2A 1BR which is authorised and regulated by the Financial Conduct Authority. Investments in SEI Funds are generally medium - to long -term investments.

This document has not been registered by the Registrar of Companies in Hong Kong. In addition, this document may not be issued or possessed for the purposes of issue, whether in Hong Kong or elsewhere, and the Shares may not be disposed of to any person unless such person is outside Hong Kong, such person is a “professional investor” as defined in the Ordinance and any rules made under the Ordinance or as otherwise may be permitted by the Ordinance.

The contents of this document have not been reviewed by any regulatory authority in Hong Kong. You are advised to exercise caution in relation to the offer. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice.

This information is made available in Latin America and the Middle East FOR PROFESSIONAL (non - retail) USE ONLY by SIEL.

Any questions you may have in relation to its contents should solely be directed to your Distributor. If you do not know who your Distributor is, then you cannot rely on any part of this document in any respect whatsoever.

Issued in South Africa by SEI Investment (South Africa) (Pty) Limited FSP No. 13186 which is a financial services provider authorised and regulated by the Financial Sector Conduct Authority (FSCA). Registered office: 3 Melrose Boulevard, 1st Floor, Melrose Arch 2196, Johannesburg, South Africa.

SIEL is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755 -1995 (the “Advice Law”) and does not carry insurance pursuant to the Advice Law. No action has been or will be taken in Israel th at would permit a public offering or distribution of the SEI Funds mentioned in this email to the public in Israel. This document and any of the SEI Funds mentioned herein have not been approved by the Israeli Securities Authority (the “ISA”).