Portfolio selection: The solver isn’t the solution.

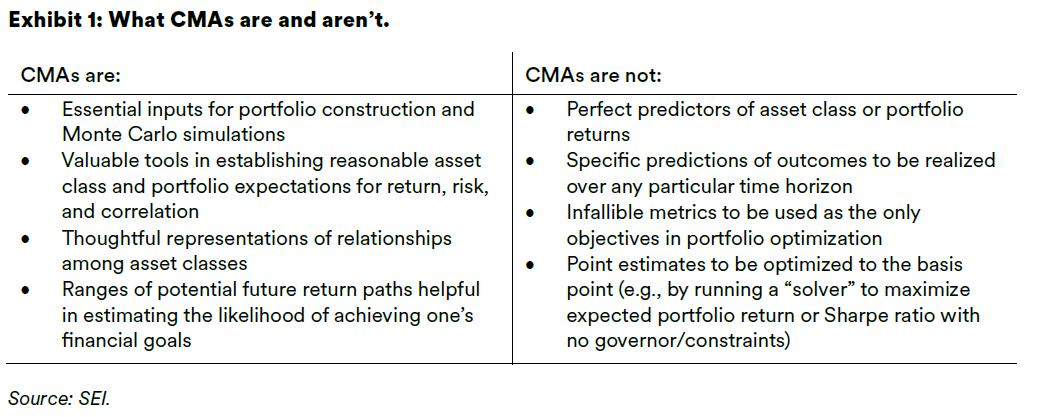

Developing capital market assumptions (CMAs)—expected returns, volatilities, and correlations across asset classes—is an incredibly important step in constructing portfolios and developing financial plans. Used properly, CMAs can help investors to better diversify their portfolios and establish reasonable expectations around the range of likely investment outcomes they might see over various time horizons. But to harness this powerful tool, it is important to understand the appropriate application of CMAs—and the potential dangers in their misuse.

“It is difficult to make predictions, especially about the future.” While this quote has been variously attributed to figures as disparate as Niels Bohr and Yogi Berra over the years, the sentiment rings true regardless of its source; prognostication is a tough business. SEI is extremely proud of our process for developing CMAs, and we believe our estimates to be unusually good, but any forecast is subject to estimation error. We employ a variety of techniques to minimize this error, but no one can eliminate it entirely. Regardless of where investors source their CMAs, these assumptions should be viewed as just one component of a robust portfolio construction process, tempered with sound judgement and an acknowledgement of uncertainty.

Pure mean-variance optimization—assuming one’s CMAs are perfect and maximizing expected risk-adjusted returns based on those exact estimates—is notoriously fragile. Small changes to CMAs, particularly expected returns, can lead to extreme shifts in ostensibly optimized portfolio weights. Given the inherent imprecision of any forward-looking estimate, this vulnerability poses a significant challenge to constructing optimized portfolios based on CMAs alone; unconstrained mean-variance optimization requires a degree of precision that is unrealistic for any forward-looking assumption.

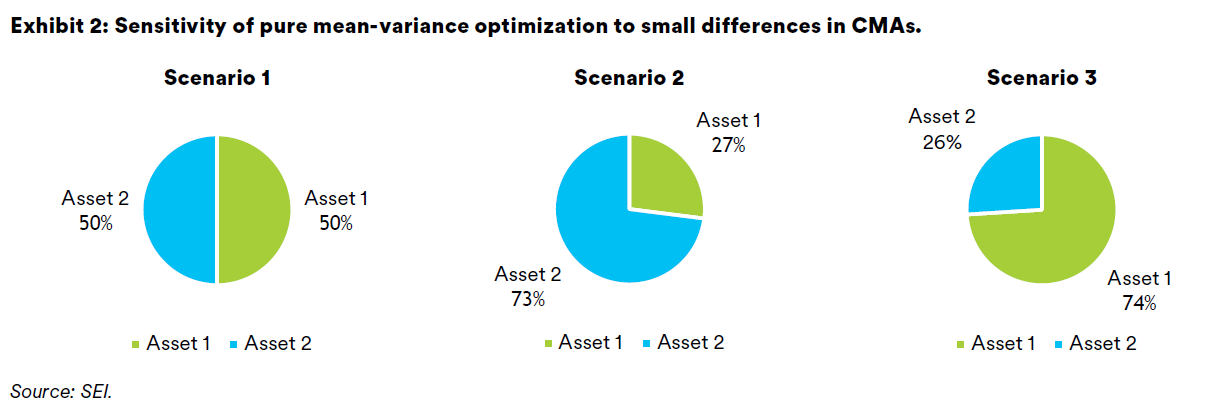

To illustrate this extreme sensitivity through an example, assume we only have two available asset classes, each with 20% expected volatility and an expected correlation of 0.9 to one another (these could represent, for instance, two different regions’ equity markets). Consider three scenarios:

- Scenario 1: Both assets have an expected excess return above cash of 5% per year.

- Scenario 2: Asset 1’s expected excess return is 5%, while Asset 2’s is 5.25%.

- Scenario 3: Asset 1’s expected excess return is 5%, while Asset 2’s is 4.75%.

In the baseline scenario (Scenario 1), the two assets have the same expected risk and return. Unsurprisingly, pure mean-variance optimization allocates the portfolio evenly between them. But when we shift Asset 2’s return by a mere 25 basis points, it yields drastically different results. Since this level of precision in forecasting returns (+/-0.25%) is virtually impossible for most asset classes (let alone one with 20% expected volatility), the sharp contrast arising from this modest shift in expected returns highlights the challenges arising from pure mean-variance optimization.

Since the optimizer (or “solver”) views these modest differences as being known with absolute certainty, it returns wildly different results under each scenario. In Scenario 2, Asset 2’s weight rises to over 73% of the supposedly optimized portfolio, while in Scenario 3, it falls to nearly 25%. These are dramatic shifts in recommended portfolio weights—and meaningful reductions in the portfolio’s level of diversification—based solely on what could generously be described as a rounding error in expected return.

This exercise underscores what we mean by the appropriate use of CMAs. While they are an indispensable tool in constructing portfolios, and no financial plan is complete without them, building portfolios with no other objective than maximizing a single point estimate for Sharpe ratio will likely prove counterproductive. We recommend a softer form of optimization that supplements estimated Sharpe ratios with additional metrics, both historical and forward-looking. This is also important in assessing potential portfolio changes: rather than strictly choosing the portfolio with a slightly higher estimated return (or slightly lower estimated risk), it is important to consider other metrics, economic intuition, and portfolio balance, among other factors.

When in doubt, diversification is generally the wise choice—not merely because it makes one’s portfolio less reliant on any single asset class, but because it makes one’s financial plan less dependent on any one assumption being perfectly precise. If an optimizer recommends an allocation tilted heavily toward one asset class, it is worth asking whether it is anchored too heavily to an error-prone estimate. Our CMAs are designed to equip investors with a best-in-class understanding of the ranges of potential portfolio outcomes, but that is only half the battle. It is also crucial that asset allocators use them wisely.

GLOSSARY AND INDEX DEFINITIONS

For financial term and index definitions, please see: https://www.seic.com/ent/imu-communications-financial-glossary

IMPORTANT INFORMATION

This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results.

Statements that are not factual in nature, including opinions, projections and estimates, assume certain economic conditions and industry developments and constitute only current opinions that are subject to change without notice. Nothing herein is intended to be a forecast of future events, or a guarantee of future results.

There are risks involved with investing, including loss of principal. The value of an investment and any income from it can go down as well as up. Investors may get back less than the original amount invested. Returns may increase or decrease as a result of currency fluctuations. Past performance is not a reliable indicator of future results. Investment may not be suitable for everyone.

This material is not directed to any persons where (by reason of that person's nationality, residence or otherwise) the publication or availability of this material is prohibited. Persons in respect of whom such prohibitions apply must not rely on this information in any respect whatsoever.

The information contained herein is for general and educational information purposes only and is not intended to constitute legal, tax, accounting, securities, research or investment advice regarding the strategies or any security in particular, nor an opinion regarding the appropriateness of any investment. This information should not be construed as a recommendation to purchase or sell a security, derivative or futures contract. You should not act or rely on the information contained herein without obtaining specific legal, tax, accounting and investment advice from an investment professional.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction. Our outlook contains forward-looking statements that are judgments based upon our current assumptions, beliefs and expectations. If any of the factors underlying our current assumptions, beliefs or expectations change, our statements as to potential future events or outcomes may be incorrect. We undertake no obligation to update our forward-looking statements.

Information in the U.S. is provided by SEI Investments Management Corporation (SIMC), a wholly owned subsidiary of SEI Investments Company (SEI).

SEI Investments Canada Company, a wholly owned subsidiary of SEI Investments Company (SEI), is the investment fund manager and portfolio manager of the SEI Funds in Canada.

Information issued in the UK by SEI Investments (Europe) Limited, 1st Floor, Alphabeta, 14-18 Finsbury Square, London EC2A 1BR which is authorised and regulated by the Financial Conduct Authority. Investments in SEI Funds are generally medium- to long-term investments.

This document has not been registered by the Registrar of Companies in Hong Kong. In addition, this document may not be issued or possessed for the purposes of issue, whether in Hong Kong or elsewhere, and the Shares may not be disposed of to any person unless such person is outside Hong Kong, such person is a “professional investor” as defined in the Ordinance and any rules made under the Ordinance or as otherwise may be permitted by the Ordinance.

The contents of this document have not been reviewed by any regulatory authority in Hong Kong. You are advised to exercise caution in relation to the offer. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice.

This information is made available in Latin America and the Middle East FOR PROFESSIONAL (non-retail) USE ONLY by SIEL.

Any questions you may have in relation to its contents should solely be directed to your Distributor. If you do not know who your Distributor is, then you cannot rely on any part of this document in any respect whatsoever.

Issued in South Africa by SEI Investment (South Africa) (Pty) Limited FSP No. 13186 which is a financial services provider authorised and regulated by the Financial Sector Conduct Authority (FSCA). Registered office: 3 Melrose Boulevard, 1st Floor, Melrose Arch 2196, Johannesburg, South Africa.

SIEL is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755-1995 (the “Advice Law”) and does not carry insurance pursuant to the Advice Law. No action has been or will be taken in Israel that would permit a public offering or distribution of the SEI Funds mentioned in this email to the public in Israel. This document and any of the SEI Funds mentioned herein have not been approved by the Israeli Securities Authority (the “ISA”).

SIMC develops forward-looking, long-term capital market assumptions for risk, return, and correlations for a variety of global asset classes, interest rates, and inflation. These assumptions are created using a combination of historical analysis, current market environment assessment and by applying our own judgment. In certain cases, alpha and tracking error estimates for a particular asset class are also factored into the assumptions. We believe this approach is less biased than using pure historical data, which is often biased by a particular time period or event.

The asset class assumptions are aggregated into a diversified portfolio, so that each portfolio can then be simulated through time using a monte-carlo simulation approach. This approach enables us to develop scenarios across a wide variety of market environments so that we can educate our clients with regard to the potential impact of market variability over time. Ultimately, the value of these assumptions is not in their accuracy as point estimates, but in their ability to capture relevant relationships and changes in those relationships as a function of economic and market influences.

The projections or other scenarios in this presentation are purely hypothetical and do not represent all possible outcomes. They do not reflect actual investment results and are not guarantees of future results. All opinions and estimates provided herein, including forecast of returns, reflect our judgment on the date of this report and are subject to change without notice. These opinions and analyses involve a number of assumptions which may not prove valid. The performance numbers are not necessarily indicative of the results you would obtain as a client of SIMC.

We believe our approach enables our clients to make more informed decisions related to the selection of their investment strategies.

For more information on how SIMC develops capital market assumptions, please refer to the SEI paper entitled "Developing Capital Market Assumptions for Asset Allocation Modeling." If you would like further information on the actual assumptions utilized, you may request them from your SEI representative.