Diversification: The Boring Winner

In a world where the best- and worst-performing asset classes tend to dominate the headlines, it’s easy to lose sight of the fact that a diversified investment portfolio is generally the most reliable approach for meeting long-term investment objectives. Diversification is a time-tested component of portfolio construction, especially through the lens of risk-adjusted returns in terms of Sharpe ratios.

Historically, the result is a less volatile portfolio that tends to produce something close to middle-of-the-road performance year in and year out. This is in contrast to the best- and worst-performing asset classes, which often generate significant media attention despite volatility in returns and market leadership—hence the sentiment that diversification is rather boring.

Diversification rarely wins in any given year …

By design, diversified portfolios hold a mix of asset classes, some of which outperform and some of which underperform in a given year. As a result, diversified portfolios will never beat the top-performing asset class in any given year. However, it’s notoriously difficult for investors to consistently pick top-performing asset classes. Nevertheless, to some investors, more-stable diversified strategies lack the appeal of flavour-of-the-month champions like the high-flying technology stocks or rapidly rising emerging markets. This point of view arises from some well-known cognitive and emotional biases, which we have covered at length in our series of Behavioural Finance papers.

To counter these biases, we developed a framework based on our analysis of three highly simplified investment strategy types (described below)—which has demonstrated the power of diversification.

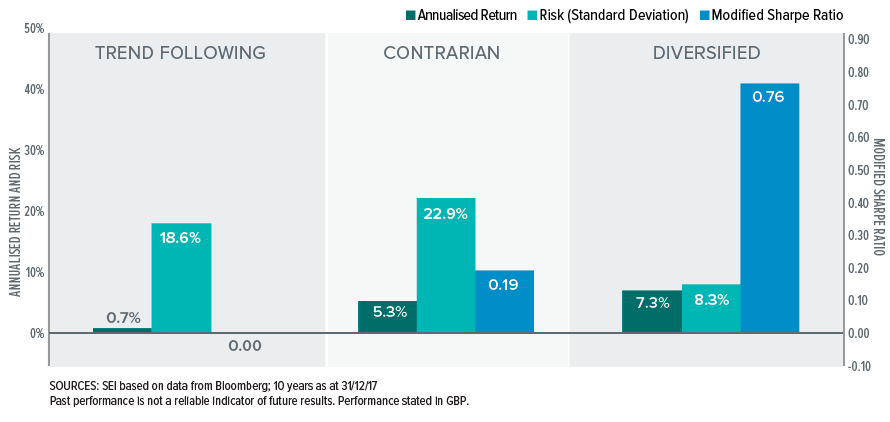

Trend-Following Strategy: Invests in the top-performing asset class of the prior year Contrarian Strategy: Invests in the worst-performing asset class of the prior year Diversified Strategy: Invests equally in all available asset classes (listed on page 3)

We found that over the last 10 years, the trend-following strategy and the contrarian strategy each were the top performer 40% of the time. Meanwhile, the diversified strategy came out on top in only two of those 10 years.

… But diversification also rarely loses, and wins over time

We’ve already established that a diversified strategy can’t beat the top-performing asset class in a given year; but, by definition, it can’t be the worst performer either.

In terms of risk-adjusted returns, despite rarely beating the two other strategies in a single year, the diversified approach has won, hands down, over the past decade. While the contrarian strategy produced solid returns overall, it still significantly trailed the diversified strategy and with much higher volatility. The trend-following strategy also had relatively high volatility and barely produced a positive return over the 10 year period. The diversified approach provided a respectable overall return with far less volatility and, as a result, much higher risk-adjusted returns.

It’s not always easy to do the right thing

This tells us that trend-following and contrarian strategies are double-edged swords; while they may offer a better chance of outperforming many asset classes and diversified portfolios, they also impose a higher

probability of significantly underperforming. Meanwhile, the relative stability conferred by a diversified strategy may help to avoid significant losses while reducing the overall volatility of the investment experience. And portfolios that can avoid extreme losses while enjoying lower volatility tend to outperform in the long run. This is why we continue to preach diversification: it may seem boring, but the past 10 years of performance illustrate that diversified strategies have offered benefits that the other approaches have failed to provide.

Important Information

This document and its contents are directed only at persons who have been classified by SEI Investments (Europe) Limited as a Professional Client for the purposes of the FCA Conduct of Business Sourcebook.

This information is issued by SEI Investments (Europe) Limited, 1st Floor, Alphabeta, 14-18 Finsbury Square, London EC2A 1BR, which is authorised and regulated by the Financial Conduct Authority.

No offer of any security is made hereby. Recipients of this information who intend to apply for shares in any SEI Fund are reminded that any such application may be made solely on the basis of the information contained in the Prospectus.

This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding the funds or any stock in particular, nor should it be construed as a recommendation to purchase or sell a security, including futures contracts.

Investments in SEI Funds are generally medium- to long-term investments. The value of an investment and any income from it can go down as well as up. Investors may get back less than the original amount invested. Diversification may not protect against market risk.

Whilst considerable care has been taken to ensure the information contained within this document is accurate and up-to-date, no warranty is given as to the accuracy or completeness of any information and no liability is accepted for any errors or omissions in such information or any action taken on the basis of this information.

Past performance is not a reliable indicator of future results.