Allocation the SEI Way

Most people love the swashbuckling Hollywood action hero who takes outlandish risks to save the day, even when faced with insurmountable odds. And it’s easy to see why: in almost every action movie, the hero wins — which is usually all we care about as viewers. But what if we adjusted those heroic victories by the risks taken or the collateral damage involved? What would the risk-adjusted outcome of the typical action movie be in the real world? Probably pretty low. While taking extreme risks makes for great story telling, the victorious endings we’ve come to expect in the movies are, in reality, highly unlikely. Even if a hero finds success when adjusting for risk, the collateral damage would probably be so excessive that it would hardly feel like a victory. Fortunately for moviegoers looking to escape reality, screenwriters don’t usually apply this kind of risk-adjusted logic to their storylines. But when it comes to the real-world challenges of saving and investing, it’s vitally important to think in risk-adjusted terms.

Consider that most investors are trying to meet a future liability of some sort. A pension fund is designed to make future payments to beneficiaries. Personal retirement accounts are meant to produce the cash flow needed to maintain a certain standard of living after we stop working. Other investment plans help prepare for a major expense, such as funding the purchase of a home or a child’s college education — also examples of future liabilities. Investors are essentially trying to get from point A today to point B (and perhaps points C, D and E) tomorrow.

Now, imagine that you’re actually standing at some physical point A and need to get to some physical point B. There’s a fairly straightforward footpath ahead of you. But there’s also a tightrope overhead, connecting A and B, as well as a trail that heads into a dank swamp full of water hazards, hungry alligators, poisonous snakes and who knows what else. Which path should you take? The answer likely seems obvious to all but the most die-hard adventurers: the direct and apparently safer path in front of you is a no-brainer choice. And if we compared, for each path, the amount of risk you have to assume to get from point A to point B — that is, if we took a risk-adjusted view — the safer, straightforward path would certainly offer the best tradeoff between risk and reward.

Translating this example to investing, while most would agree that it’s important to avoid needlessly turning a portfolio into a high-wire act or back-country adventure, the risks in financial markets are not as apparent or as intuitive as a tightrope or a swamp full of ravenous reptiles. In other words, determining the most appropriate investment path is not such a no-brainer. On the contrary: Human behavioral tendencies lead many investors onto riskier paths — either intentionally, due to a personal sense of adventure, or (perhaps more commonly) unintentionally, due to a lack of knowledge or planning that causes someone to veer off track. And some investors may also be pushed onto a riskier-than-needed path by certain traditional industry offerings. But the bottom line is, by taking risks that you are not adequately compensated for, you are embarking on what is likely to be a bumpier-than-necessary ride that can cause you to ultimately fall short of your destination. Smart investing involves striking the best available composition and balance of risks for a desired rate of return.

Strategic Asset Allocation: The Foundation

So how do you do this? In the complex world of financial markets, how do you design a strategy that offers the most attractive risk profile for a desired return? It’s perhaps the single greatest challenge to an investor’s long-term success, and it’s one that we at SEI take seriously. In fact, we have played, and continue to play, a vital role in the development of some of our industry’s best thinking — including pioneering research that demonstrates that strategic asset allocation (a portfolio’s targeted mix of underlying holdings) is the overwhelming determinant of an individual’s investment experience. [1]This research highlights the fact that a well-designed portfolio is the foundation for investment success. And the cornerstone of that foundation is diversification.

The importance of diversification is now well understood, but that wasn’t always so. Through the first half of the twentieth century, it was widely believed that if an investor simply allocated funds to enough securities (roughly 20 or more), the law of large numbers would prevent disaster. But in the 1950s and 1960s, a number of scholars showed that this logic was flawed, that a more mathematical and scientific approach to portfolio diversification was possible, and that investors could seek to minimize risk (measured as volatility of returns) for any desired level of return.[2] It took several decades for this body of knowledge, now known as Modern Portfolio Theory (MPT), to begin catching on in practice. While diversification and MPT receive plenty of lip service nowadays, we believe that standard investment offerings have yet to fully incorporate the concepts and insights of MPT. There is still much work to be done.

Capital Market Assumptions: The Raw Materials

What’s involved in constructing an appropriate strategic allocation? The first step in designing such a portfolio is to form reasonable, well-grounded expectations about how various asset classes are likely to perform — not just their average annual returns, but also their volatilities and how they compare to one another. Do some assets tend to move in sync? When one asset class is doing well, do others tend to fare poorly? Are there common factors that drive the behavior of different assets? These expectations are referred to as capital market assumptions, or CMAs. If CMAs are not consistent with market reality, they can lead to suboptimal (or even nonsensical) portfolio recommendations. They are an excellent example of the old computer science adage, “garbage in, garbage out.” Good portfolio design relies upon sound, internally consistent CMA inputs, which require considerable quantitative analysis and skilled professional judgment. When developing CMAs, it’s also important to consider how asset-class behaviors may change in different market environments (such as bull markets, bear markets or even a full-blown financial panic) and different economic regimes (for example, fast or slow economic growth, or whether prices are rising or falling). It’s probably true that few investors care to look under the hood at the technical aspects of CMA generation; however, it’s a critically important step in portfolio construction. We believe it’s an area that’s ripe for further evolution, thanks to recent advances in economic modelling techniques and data-processing technologies.

Portfolio Optimization: The Philosophy of Design

With CMAs in hand, we proceed to optimization. Optimization involves mathematical techniques and processes that aim to identify the lowest-risk portfolio for any desired level of return (or the highest-return portfolio for any given level of risk). While the mathematical techniques involved are widely agreed upon, the results are quite sensitive to the inputs and the assumptions surrounding them. As a result, professional judgment plays a critical role in this process. Our optimization approach is firmly grounded in our allocation philosophy, which emphasizes the following: the distinction between risk and uncertainty; the impact of path dependence; and the importance of understanding the sources of risk in a portfolio.

First, economists have long made a distinction between risk and uncertainty[3]; while it may seem subtle, it’s actually quite important to the investment process. The essential difference is that risk is quantifiable, involving known outcomes with associated probabilities, and uncertainty describes possibilities that are not known in advance. Returning to our opening example, you could say that a tightrope represents risk — you’ll either fall or you won’t, with the possible consequences being fairly obvious — while the swamp, with its myriad unknown dangers, represents uncertainty. Rolling dice is another good example of risk versus uncertainty. On a normal die, the possible outcomes are one through six, and each outcome has an equal probability as long as the die is balanced. Thus, for any given number of rolls, the distribution of possible outcomes is known in advance. However, if a die has an unknown number of sides, or sides with unknown values, we are then in the realm of uncertainty. Financial markets are subject to both risk and uncertainty; good portfolio design requires practitioners to be cognizant of this, as it strengthens the case for diversification even further.

Second, while compound interest has been referred to as one of humanity’s greatest inventions[4], it has a dark side: negative returns also compound, but to the downside. (Economists refer to this as path dependence.) Thus, a string of negative returns can have a profound and lasting impact on a portfolio’s value. This can be especially challenging for investors who, for example, just entered retirement. If severe enough, it could force them to change their desired lifestyle considerably or even send them back into the workforce. Path dependence, like uncertainty, calls for more (and better) diversification, not less.

Finally, effective diversification requires a thorough appraisal of a portfolio’s sources of risk. This goes beyond simply estimating overall expected risk; it involves decomposing that expected risk into its subcomponents. This is important because risk allocation (the percentage of portfolio volatility driven by its holdings of stocks, bonds and cash, for example) can be very, very different from capital allocation (the percentage allocations to stocks, bonds and cash). This appraisal can be carried out by asking, for example, how much of a portfolio’s expected risk is attributable to changes in interest rates, unexpected changes in inflation or other economic surprises, stock market movements or other factors. There are countless ways to frame this kind of analysis, and it involves both art and science. But it is beyond doubt that stock market-related risk dominates many standard industry offerings, as stocks tend to be more volatile than most other asset classes. For example, almost all volatility of a “balanced” portfolio of 60% stocks and 40% bonds is going to arise from its 60% allocation to stocks. Even in conservative portfolios with small allocations to equities, stock-market movements can drive over half of the volatility. SEI has played a leading role in identifying and developing solutions that help better balance the sources of risk within portfolios, and will continue to do so. This includes the use of additional asset classes and non-traditional investments, such as multi-asset and objective-based funds. We are also investigating ways of more fully incorporating the insights of MPT into strategic asset allocation in order to improve the risk balance (and risk-adjusted return potential) of many portfolios.

The bottom line is that uncertainty is always present in financial markets and demands more — not less —diversification; the compounding of risk and uncertainty means that potential outcomes vary increasingly over time; and striking a better balance among the sources of risk in a portfolio can help to deal with these realities.

The Result: Not Flashy, But Reliable

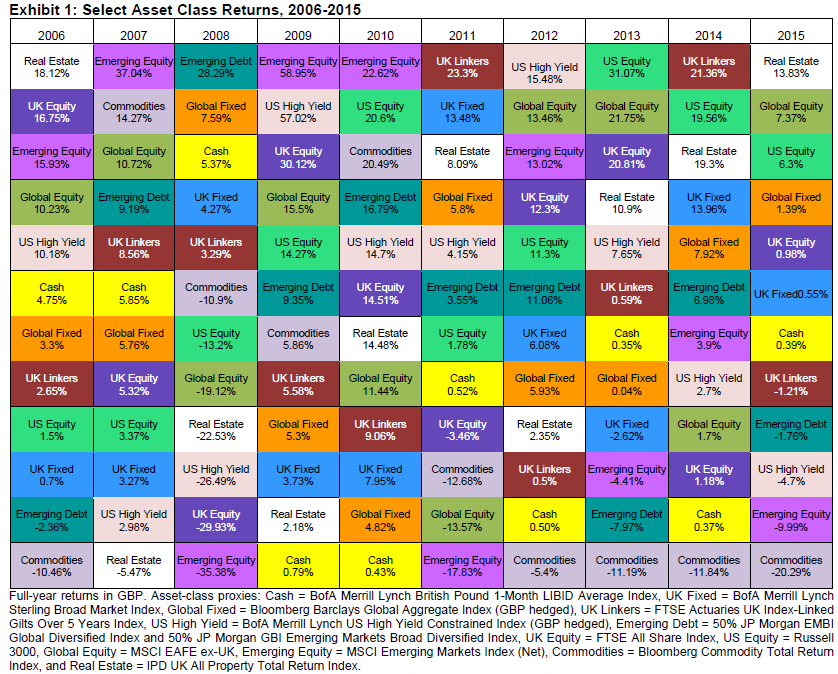

So what does a well-thought-out approach to strategic allocation get you? If you’re not careful, serial disappointment. Why? Because it’s virtually guaranteed that a diversified portfolio will never outperform every individual asset class. Comparing the overall performance of your portfolio to the best-performing asset class (or classes) in a given year is simply the wrong way to look at it; yet far too many investors do just that. And the temptation (thanks to overconfidence and hindsight bias) to counter subsequent disappointment by trying to pick next year’s winner rather than investing in a safer-but-boring, middle-of-the-road portfolio is understandable. But consider the annual asset class returns shown in Exhibit 1. From 2006 to 2015, the momentum approach — that is, picking the prior year’s winner — would have outperformed the other two strategies 45% of the time. Over the same period, a contrarian approach — that is, picking the prior year’s loser — would have won 36% of the time. And a naïve portfolio with equal weights in all 12 asset classes would only have beaten these two approaches twice during this period. So why in the world would you choose to diversify? Because your return over the full 10 years would have been one and a half times higher than the contrarian strategy and more than two times higher than the momentum strategy, with only around a third the volatility! In risk-adjusted terms, a diversified approach would have won, hands down.

Of course, despite the impressive weight of historical evidence, holding a diversified portfolio still requires discipline, patience and the right focus. An investor who pays too much attention to the hot, outperforming asset class in any period may abandon what is clearly the better approach. This is especially true in periods when asset class performance is concentrated within one or two significant outperformers, as we saw, for example, with U.S. stocks from 2012 through 2015. In some situations, an investor may be better served by a portfolio that, despite being less optimal in purely quantitative terms, is designed to manage emotional biases in order to keep an investment plan on track. Our thought leadership in this area[5] led to the creation of our goals-based solutions, which seek to increase the odds that an investor will stick with an appropriate strategy.

Active Asset Allocation

Does it ever make sense to diverge from a strategic asset allocation? As pointed out earlier, it’s important to understand that strategic allocation drives almost all of an investor’s experience. However, we believe active allocation tilts can make sense for investors willing to deviate modestly from a strategic allocation. This view is based on our belief that, while markets are equilibrium seeking, they almost always display some degree of disequilibrium. In finance jargon, they are not completely “efficient,” meaning prices don’t fully reflect available information— emotion, sentiment and various other factors are also important drivers of prices. As a result, market mispricings can and do occur, creating opportunities for investors who are willing to assume the risk of an active trade. When successful, these active allocation tilts can enhance a portfolio’s risk-adjusted returns.

However, active tilts should be executed within a disciplined risk-budgeting framework. Allowable differentiation from the strategic portfolio should be specified at the time of an investment plan’s inception. And, again, the strategic allocation will drive the bulk of the investment experience. Active allocation tilt will likely have a modest impact, at most; a bigger impact would imply that the tilts are large enough to constitute a change of strategy, indicating a loss of discipline. And, as the previous section shows, a series of concentrated active bets are likely to underperform a diversified portfolio, especially in risk-adjusted terms.

Trying it All Together

Sound approaches to portfolio theory and strategy are a relatively recent development, at less than 70 years old. The early MPT theorists weren’t awarded Nobel prizes until the 1990s, when some of their insights were just starting to take root in the industry. It would be a mistake to think that the investment industry has incorporated everything that finance theory has to offer, or that more can’t be done to manage risk and uncertainty, mitigate the occurrence of inferior outcomes, better balance risks within a portfolio, or take advantage of compelling active allocation opportunities when they arise. SEI has long played an industry-leading role in this and other areas, and will continue to do so in the years ahead.

1 Brinson,Gary P., L. Randolph Hood, and Gilbert L. Beebower.“Determinants of Portfolio Performance.”Financial Analysts Journal(July-August 1986),pp 39-44;

2 Mark Rubinstein (2002). “Markowitz’s ‘Portfolio Selection’: A Fifty-Year Retrospective.” The Journal of Finance, Vol. LVII, No. 3, pp. 1041-1045.

3 Frank H. Knight (1921). Rick, Uncertainty and Profit. Boston, MA: Hart, Schaffner & Marx; Houghton Mifflin Co.

4 http://quoteinvestigator.com/2011/10/31/compound-interest/ <last accessed on 9/28/2016>

5 Dan Nevins (2003). “Goals-based Investing: Integrating Traditional and Behavioral Finance.” SEI Investments Research

Important Information

This document and its contents are directed only at persons who have been classified by SEI Investments (Europe) Limited as a Professional Client for the purposes of the FCA Conduct of Business Sourcebook.

This information is issued by SEI Investments (Europe) Limited, 1st Floor, Alphabeta, 14-18 Finsbury Square, London EC2A 1BR, which is authorised and regulated by the Financial Conduct Authority.

No offer of any security is made hereby. Recipients of this information who intend to apply for shares in any SEI Fund are reminded that any such application may be made solely on the basis of the information contained in the Prospectus.

Whilst considerable care has been taken to ensure the information contained within this document is accurate and up-to-date, no warranty is given as to the accuracy or completeness of any information and no liability is accepted for any errors or omissions in such information or any action taken on the basis of this information.

Diversification may not protect against market risk.Past performance is not a guarantee of future performance. Investments in SEI Funds are generally medium to long term investments. The value of an investment and any income from it can go down as well as up. Fluctuations or movements in exchange rates may cause the value of underlying international investments to go up or down. Investors may not get back the original amount invested. SEI Funds may use derivative instruments which may be used for hedging purposes and/or investment purposes.This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events. This information should not be relied upon by the reader as research or investment advice regarding the funds or any stock in particular, nor should it be construed as a recommendation to purchase or sell a security, including futures contracts.

SEI sources data directly from FactSet, Lipper, and BlackRock unless otherwise stated.