Central bank depository

SEI’s view

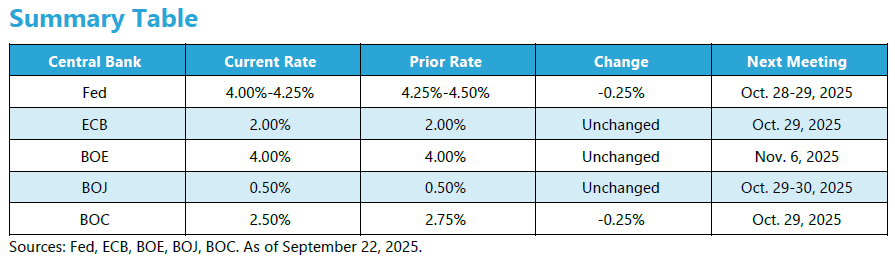

As expected, softening labor-market conditions provided the rationale for the Federal Reserve (Fed) to reduce the federal funds rate by 25 basis points (0.25%) in September. The inflation outlook provides less support. Core inflation, as measured by the year-over-year personal-consumption expenditures (PCE) price index, has moved back up toward 3%, well above the Fed’s 2% target. Services inflation remains quite elevated, rising 3.8% over the 12 months ended July. We note that durable goods prices are on the rise again. The Trump administration’s tariffs on imported goods, the U.S. dollar’s decline, and the disruption of long-established supply chains away from China may finally be showing up in the data. The resulting price increase, 1.1% over the past year, is still modest. But compared to the long deflation in durable-goods prices starting in 1995 and lasting until the COVID-19-related supply-chain snags earlier this decade, we consider this change in trend to be noteworthy. The U.K. continues to record the highest inflation rate for services, running 4.7% over the 12-month period ending in August. The nation also has the highest wage growth. Other countries, including the U.S., have seen improvement. U.S. services inflation, however, has been hovering around an annual rate of 3.8% throughout 2025. The weaker economies of Canada and the eurozone have recorded further deceleration in growth, justifying the easier monetary policies those central banks have pursued.

Federal Reserve (Fed)

- In a split 11-1 vote, the Federal Open Market Committee (FOMC) reduced the federal funds rate by 0.25% to a range of 4.00% to 4.25% following its meeting on September 16-17—its first rate cut since December 2024. Stephen Miran, a recent appointee of President Donald Trump, supported a 0.50% rate decrease.

- In a statement announcing the rate decision, the FOMC commented, "In considering additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks."

- The Fed's so-called dot plot of economic projections indicated a median federal funds rate of 3.6% at the end of 2025, down from its previous estimate of 3.9% issued in June, signaling that the central bank anticipates two more federal funds rate cuts by the end of this year. The Fed estimated that core inflation, as measured by the core PCE price index—which measures the prices that consumers pay for goods and services (excluding volatile food and energy prices) to reveal underlying inflation trends—will rise 3.1% for the 2025 calendar year, unchanged from its forecast in June. Additionally, the FOMC pegged U.S. gross domestic product (GDP) at 1.6% in 2025—an upward revision from the projected 1.4% annual growth rate in its previous dot plot.

European Central Bank (ECB)

- As widely anticipated, the ECB left its benchmark interest rate unchanged at 2.00%—its lowest level since November 2022—following its meeting on September 10-11, citing concerns regarding the impact of the Trump administration’s tariffs on inflation and economic growth in the region.

- In a news release announcing the rate decision, the ECB’s Governing Council noted that its inflation outlook is unchanged since its meeting in August and that it is “determined to ensure that inflation stabilises [sic] at its 2% target in the medium term.”

- The Governing Council also said that its “interest rate decisions will be based on its assessment of the inflation outlook and the risks surrounding it, in light of the incoming economic and financial data, as well as the dynamics of underlying inflation and the strength of monetary policy transmission. The Governing Council is not pre-committing to a particular rate path.”

Bank of England (BOE)

- At its meeting on September 17, the BOE voted by a 7-2 margin to maintain the Bank Rate at 4.00%—remaining at its lowest level since March 2023. Two BOE Monetary Policy Committee (MPC) members favored a 0.25% reduction to the policy rate.

- Additionally, the MPC will slow the pace of the reduction of its holdings in U.K. gilts between October of this year and September 2026, to £70 billion from £100 billion over the previous 12-month period, in an effort to ease the upward pressure on gilt yields.

- During a news conference on September 18, BOE Governor Andrew Bailey said, ”The new target means the MPC can continue to reduce the size of the Bank's balance sheet in line with its monetary policy objectives while continuing to minimize the impact of gilt market conditions.”

- According to minutes of the meeting, the MPC members “judged that a gradual and careful approach to the further withdrawal of monetary policy restraint remained appropriate. The restrictiveness of monetary policy had fallen as Bank Rate had been reduced. The timing and pace of future reductions in the restrictiveness of policy would depend on the extent to which underlying disinflationary pressures would continue to ease.”

Bank of Japan (BOJ)

- By a 7-2 majority, the BOJ voted to maintain its benchmark interest rate at 0.50% at its meeting on September 18-19, indicating a sooner-than-expected unwinding of its monetary stimulus. The central bank has stood pat since raising the rate by 0.25% in late January of this year. Two BOJ Policy Board members favored a 0.25% rate hike.

- In a statement announcing the rate decision, the BOJ projected that the country’s economic growth will moderate “as trade and other policies in each jurisdiction lead to a slowdown in overseas economies and to a decline in domestic corporate profits and other factors, although factors such as accommodative financial conditions are expected to provide support.” The central bank also announced the sale of its holdings in exchange-traded funds (ETFs) (¥330 billion or $2.2 billion annually) and Japanese real-estate investment trusts (J-REITs) (¥5 billion or $33.8 million per year).

- At a news conference following the central bank’s meeting, BOJ Governor Kazuo Ueda commented that he is monitoring the economic impact of the Trump administration’s tariffs. “So far, we're not seeing a major impact from U.S. tariffs on Japan's economy,” he said. “But we need to be mindful of downside economic and price risks, as the impact from U.S. tariffs will start to intensify."

Bank of Canada (BOC)

- At its September 17 meeting, the BOC reduced its policy rate by 0.25% to a three-year low of 2.50%—the first rate cut since March of this year.

- In a statement announcing the monetary policy decision, the BOC noted that, given Canada’s weaker economic outlook and lower risk of higher inflation due to the Canadian government’s removal of most retaliatory tariffs on imported goods from the U.S., “[the BOC] Governing Council judged that a reduction in the policy rate was appropriate to better balance the risks.”

- During a news conference following the rate-cut announcement, BOC Governor Tiff Macklem acknowledged the ongoing uncertainty surrounding the Trump administration’s tariffs on imported goods from Canada. “Through the recent period of trade upheaval, Governing Council has been proceeding carefully, paying particular attention to the risks and uncertainties facing the Canadian economy,” he commented.

Important Information

This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. All information as of the date indicated. There are risks involved with investing, including possible loss of principal. This information should not be relied upon by the reader as research or investment advice, (unless you have otherwise separately entered into a written agreement with SEI for the provision of investment advice) nor should it be construed as a recommendation to purchase or sell a security. The reader should consult with their financial professional for more information.

Statements that are not factual in nature, including opinions, projections, and estimates, assume certain economic conditions and industry developments and constitute only current opinions that are subject to change without notice. Nothing herein is intended to be a forecast of future events, or a guarantee of future results,

Certain economic and market information contained herein has been obtained from published sources prepared by other parties, which in certain cases have not been updated through the date hereof. While such sources are believed to be reliable, neither SEI nor its affiliates assumes any responsibility for the accuracy or completeness of such information and such information has not been independently verified by SEI.

There are risks involved with investing, including loss of principal. The value of an investment and any income from it can go down as well as up. Investors may get back less than the original amount invested. Returns may increase or decrease as a result of currency fluctuations. Past performance is not a reliable indicator of future results. Investment may not be suitable for everyone.

This material is not directed to any persons where (by reason of that person's nationality, residence or otherwise) the publication or availability of this material is prohibited. Persons in respect of whom such prohibitions apply must not rely on this information in any respect whatsoever.

The information contained herein is for general and educational information purposes only and is not intended to constitute legal, tax, accounting, securities, research or investment advice regarding the strategies or any security in particular, nor an opinion regarding the appropriateness of any investment. This information should not be construed as a recommendation to purchase or sell a security, derivative or futures contract. You should not act or rely on the information contained herein without obtaining specific legal, tax, accounting, and investment advice from an investment professional.

Information in the U.S. is provided by SEI Investments Management Corporation (SIMC), a wholly owned subsidiary of SEI Investments Company (SEI).

Information in Canada is provided by SEI Investments Canada Company, a wholly owned subsidiary of SEI Investments Company (SEI), and the Manager of the SEI Funds in Canada.

In the UK and the EEA this information issued in the UK by SEI Investments (Europe) Ltd, 1st Floor, Alphabeta, 14-18 Finsbury Square, London EC2A 1BR which is authorised and regulated by the Financial Conduct Authority.

The contents of this document have not been reviewed by any regulatory authority in Hong Kong. You are advised to exercise caution in relation to the offer. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice.

This document has not been registered as a prospectus with the Monetary Authority of Singapore.

This information is made available in Latin America and the Middle East FOR PROFESSIONAL (non-retail) USE ONLY by SIEL.

Any questions you may have in relation to its contents should solely be directed to your Distributor. If you do not know who your Distributor is, then you cannot rely on any part of this document in any respect whatsoever.

Issued in South Africa by SEI Investments (South Africa) (Pty) Limited FSP No. 13186 which is a financial services provider authorised and regulated by the Financial Sector Conduct Authority (FSCA). Registered office: 3 Melrose Boulevard, 1st Floor, Melrose Arch 2196, Johannesburg, South Africa.