Our Story

SEI doesn't follow trends, we seek to stay ahead of them

- 1968

- 1970s

- 1986

- 1990s

- 2000s

- 2004

- 2010

-

1968

It started with an idea

SEI recognised the need for faster and better training in lending practices, and created the first computer-simulated training technology for loan officers.

-

1970s

Focusing on the trust and estates industry

When trust departments were still largely functioning as a “paper and pencil” business, SEI transformed the industry by creating a completely automated trust accounting system.

-

1986

Entering the asset management business

SEI helped change the way people look at investing by integrating modern portfolio theory with comprehensive asset allocation models — a process that now is an investment cornerstone.

-

1990s

Launching a wealth management operating platform

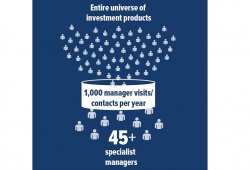

SEI launched a wealth management operating platform for independent, fee-based investment advisers, further transforming the industry by aligning advisers’ business interests with their clients’ investment success. SEI was also among the first companies to offer the Manager-of-Managers investment programs to both institutional and individual investors in the United States, Europe, Canada, South Africa, and Asia.

-

2000s

SEI introduced...

- A pension management solution that integrates pension decisions with corporate finance objectives, enabling corporate managers to more fully address how pensions impact the company’s financial position - An all-encompassing infrastructure for investment managers called Total Operational Outsourcing that provides an integrated platform for the processing of all investment types. - SEI Wealth Platform - for private banks and wealth management organisations, a comprehensive suite of services built around a single, unified platform and designed to support every facet of a global wealth management business. Today, we process private banking business in 52 countries, transact in 40 currencies, and trade on 136 exchanges (as at 31st March 2016).

-

2004

Managing volatility

SEI partnered with six leading investment firms to test strategies that manage absolute rather than relative risk. SEI’s U.S. Managed Volatility Fund was one of the first of its kind, launched in November 2004. The Fund has since been joined by four other SEI Managed Volatility funds globally, all of which are used in SEI’s Goals-based solution.

-

2010

Developing new strategies

Objective-based investing in SEI’s multi-asset strategies goes beyond the traditional stocks, bonds and cash approach in an effort to enable investors to consistently meet specific objectives with an appropriate level of risk.